Media Company Enhances Reach with Custom OTT Streaming App

- Mobile App

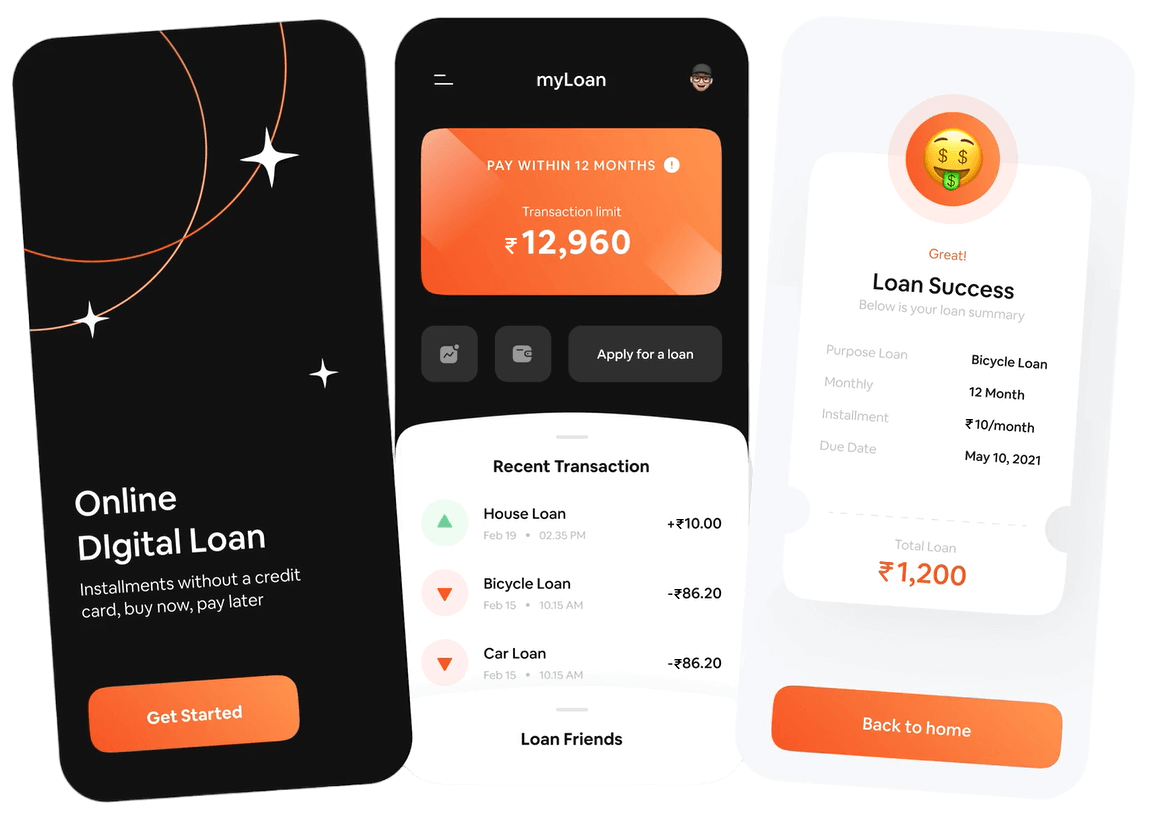

A leading Indian NBFC enhances operational efficiency and customer service through digital transformation, focusing on implementing advanced loan management systems and automation to drive growth and improve compliance.

A prominent Non-Banking Financial Company (NBFC) in India, specializing in providing loans to small and medium-sized enterprises (SMEs) and individual borrowers. With a strong presence in both urban and rural areas, NBFC has built a reputation for offering flexible loan products and efficient customer service. However, their legacy loan management system was limiting their growth potential and operational efficiency.

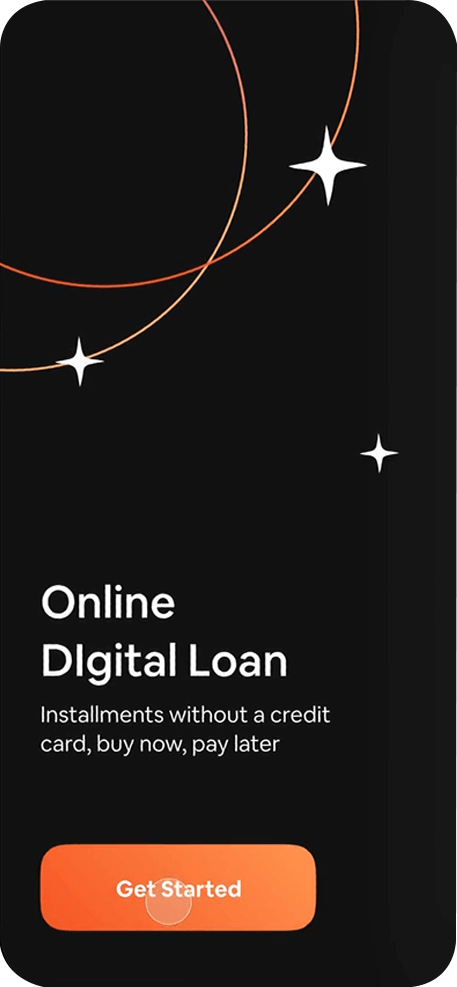

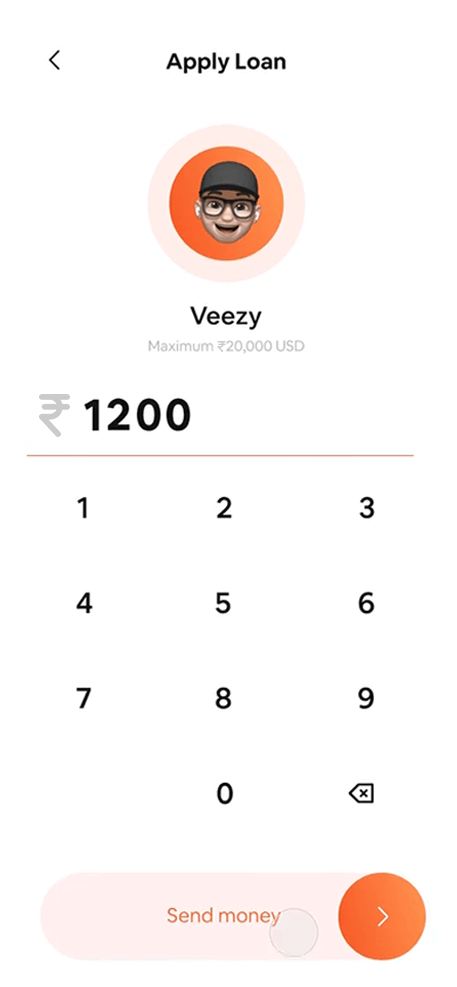

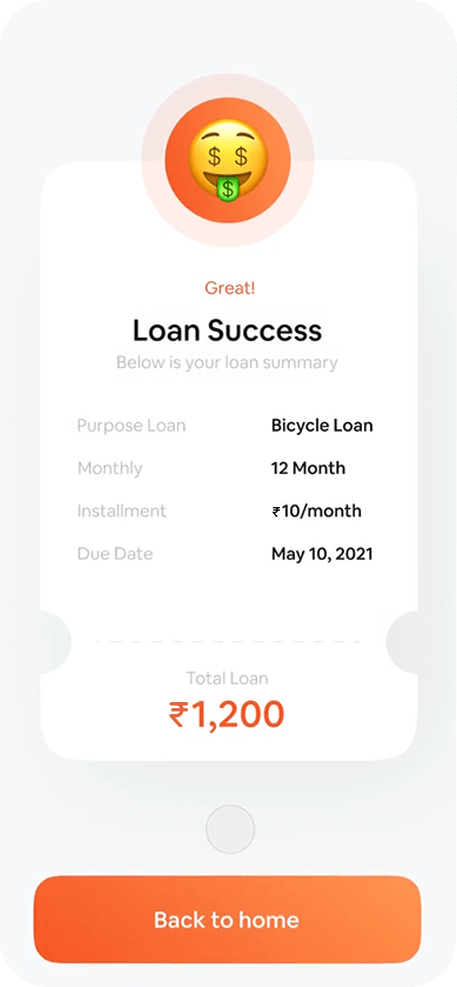

The primary objective of the project was to develop a comprehensive loan management platform. The scope included:

Designing and developing a robust, scalable, and secure loan management system.

Integrating the platform with existing financial systems and third-party services.

Implementing advanced features to streamline loan processing, approval, and disbursement.

Enhancing data security and ensuring compliance with regulatory standards.

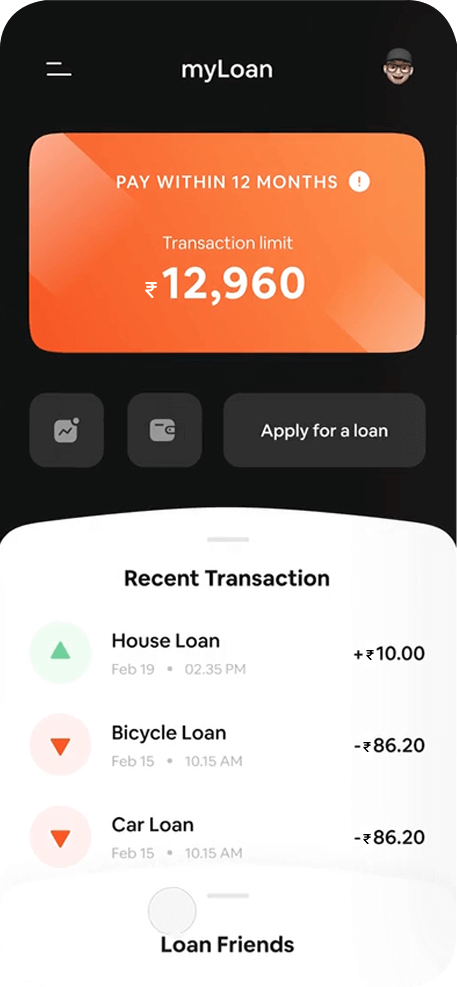

We proposed automating the loan disbursal process using Datamatics’ proprietary tools:

Data Capture: TruCap+ automatically captured data from Excel files containing loan requests.

Eligibility Check: The system verified customer eligibility based on predefined criteria.

| Milestone | Tasks | Timeline | Responsible |

|---|---|---|---|

| Project Initiation | – Requirements gathering – Stakeholder meetings |

1 month | Project Manager, Business Analyst |

| Planning | – Project plan development – Resource allocation |

1 month | Project Manager |

| System Design | – Architectural design – UI/UX design – Database design |

2 months | Solution Architect, UI/UX Designer, Database Administrator |

| Development Phase 1 | – Frontend development – Backend development |

4 months | Frontend Developers, Backend Developers |

| Development Phase 2 | – API integration – Security implementation |

3 months | Backend Developers, Security Specialists |

| Testing Phase 1 | – Unit testing – Integration testing |

2 months | QA Engineers |

| Testing Phase 2 | – User acceptance testing – Performance testing |

2 months | QA Engineers, End Users |

| Deployment | – Setup production environment – Data migration – Go-live |

1 month | DevOps Engineers, Database Administrator |

| Post-Deployment Support | – Monitoring – Bug fixing – User training |

4 months | Support Team, Trainers |