Blockchain Smart Contract For Insurance: Simplifying Claim Settlement Process

Insurers are among the many players rushing to figure out how blockchain and smart contract might be used to improve fraud detection, transaction execution, and stakeholder interaction. Recently The NineHertz has partnered on a claims handling management software project to strengthen critical parts of Claims Management Services.

We developed a solid, scalable, and high-performing application to streamline a leading Insurance service provider’s claim handling system. Our talented blockchian application developers built this application using the Vue.JS framework, improving the overall claim management process, enhancing claim service, boosting customer satisfaction, and reducing overall costs.

- Industry

- Blockchain

- BA (2)

- Project Manager (1)

- Developers (3)

- Designers (2)

- QA Testers (2)

Of unstoppable work

- Smart Contract

- Azure Cloud Services

- Vue.Js Framework

- Blockchain Technology

- distributed ledger

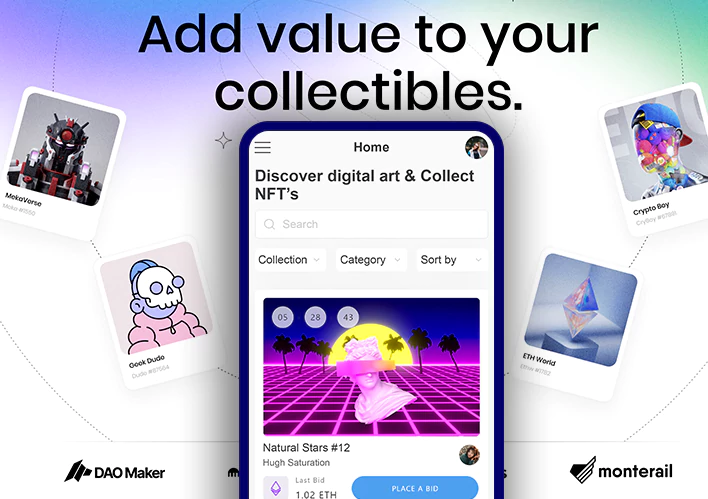

- Cryptocurrency

- AI & IoT

Let’s Discuss Your Project

Get free consultation and let us know your project idea to trun it into an amazing digital product.

Challenges Of Insurance Claim Management System Using Blockchain

Fraud Detection

The insurance claim process uses several data sources from various systems, which enhances the possibility of fraudulent claims. This was our developers’ most significant issue in figuring out how to identify fraud claims utilizing a wider amount of data.

Manual Process Of Claim

With claims processing and record management from customers, employees, agents, and third parties, the manual Process has posed a daily challenge to the business. The next problem our developers had to solve was connecting end-to-end jobs and connecting every user of the claim management process.

Data Privacy

Healthcare insurance is one of the most inefficient and fraud-prone industries today. We faced numerous issues in maintaining patient privacy, compliance requirements, and so on because it contained PII data.

Data Compliance

Property and casualty insurance necessitates a great deal of manual data and coordination. Therefore, there can be numerous inaccuracies. As a result, our developers had to explore ways to establish a permanent audit trail, automate claims processing, and digitally track and manage tangible assets to make the software error-free.

How Did We Solve The Challenge?

Smart Contract Technology

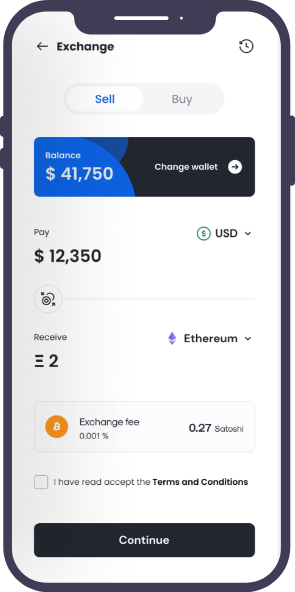

A decentralized Insurance Claims Management Software was created by our developers using smart contract technology that automates insurance transactions and processing. It also enables the creation of decentralized insurance apps, which allow for more efficient insurance acquiring and selling at lower operational costs. In addition, smart contracts can independently validate claims using numerous data sources.

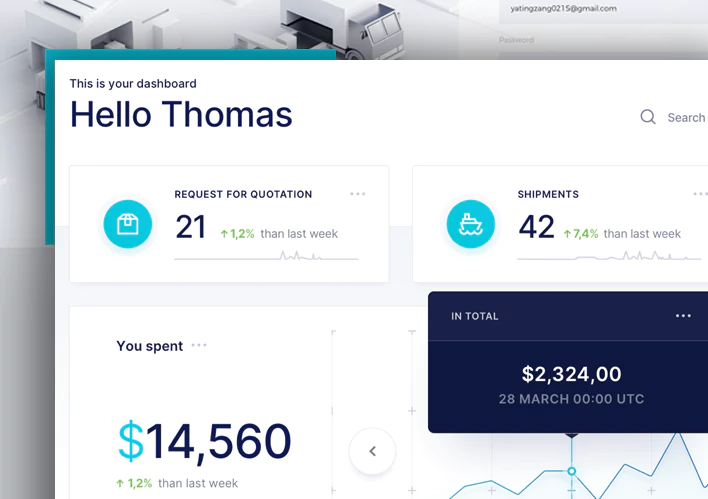

Single Page View

Our web application developers are well-versed in modern-day technology. Given the intricacy, our developers leveraged Azure Cloud Services and the Vue.JS framework in the development process, resulting in a single-page progressive web application (PWA) that can be accessed from any location and at any time.

Decentralized Medical Records Management System

We created a decentralized medical records management system that indexes medical records on the blockchain and grants access to only those allowed. It helps protect patients’ privacy while also making the information verification process more accessible.

Digital Tracking

We created a blockchain technology that has the potential to completely alter the way physical assets are managed, tracked, and insured digitally. For example, when the ships enter high-risk locations, such as conflict zones, the platform detects and alerts them. In addition, it can assist speed up the process of making and verifying claims by providing a reliable store of data.

Key Features

The NineHertz insurance blockchain: simplifying claim settlement process with the following must-have features.

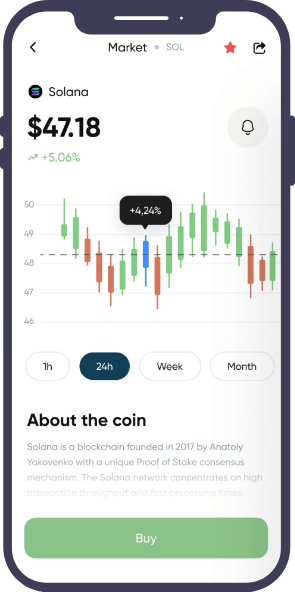

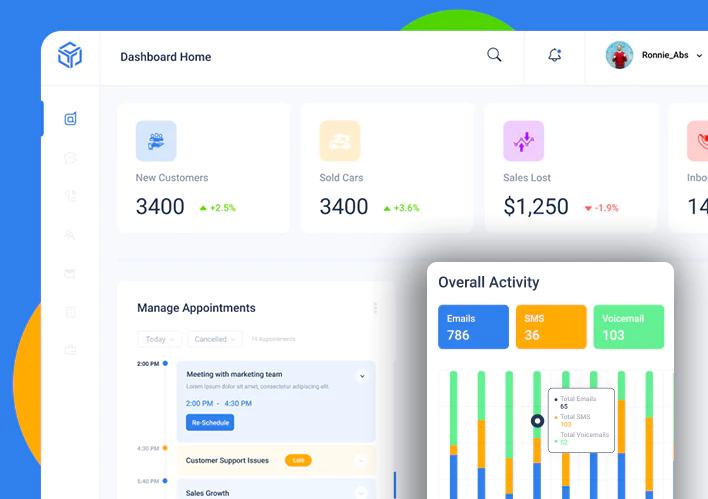

User App Features

- Reduce Claims Management Cost You can deploy smart solutions and significantly increase your operational efficiency while saving time and money with claims processing software.

- Settle Claims Faster Adopting automated insurance claims management software will streamline the entire process for you and your policyholders.

- End-to-End Visibility From a single claims management system, have complete visibility of the claims timeline and associated procedures – including those on different backend systems.

- Shorten Claims Life Cycle Automating the entire claims cycle with insurance claims management software reduces manual errors and eliminates repetitive work.

- Prevent Claims Leakage and Frauds Give your team the tools to evaluate claims data in a unified claims processing system and identify any breaches.

- Improve Underwriting Quality For more effective risk selection and evaluation, use data-driven capabilities to power your underwriting decisions.

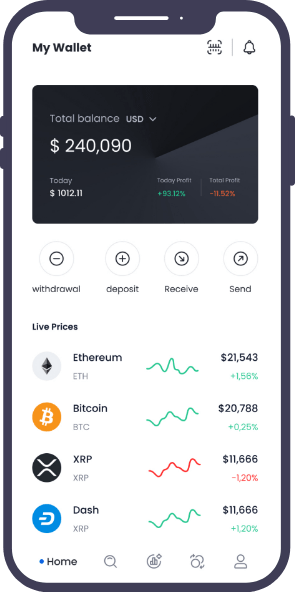

Consumer Features

- Able to apply claim online via browser or smartphone from office/home

- Able to check their current claim application status

- Allowed to access their records only

- Able to view their approved claim details

Approving Officers

- First Level & Second Level Approving Officers can Approve / Reject consumer claim applications.

- Allowed to view their department’s employees’ claim details only

- Able to access the reports to view/claims applied details

Let’s Discuss Your Project

Get free consultation and let us know your project idea to trun it into an amazing digital product.

Project Milestones We Achieved

- 01

Requirement Gathering

First we sign the NDA with the client and after that we start gathering the relevant information for the app.

Duration15 to 20 daysTeam MembersBusiness Analyst and QA - 02

App Designing

Our designers now start designing different app screens and wireframes to give seamless user experiences with a flawless look.

Duration20 to 30 daysTeam MembersUI & UX Designers, BA - 03

App Development

By using the latest technologies and tools, our expert app developers develop interactive prototypes that attract user’s attention.

Duration40 to 50 daysTeam MembersExpert Developers, Designers, BA - 04

App Testing

In the final step, our QA team performs various analyses and validations to make sure that the app runs flawlessly.

Duration15 to 20 daysTeam MembersQA, Developers, BA, Project Manager

Work Gets More Appreciation Than Words

Let’s talk more about your plan. Get a free consultancy and no-binding quotation for your project.