No wonder it’s frustrating to get stuck in a never-ending loop of “press 1 for this” and “press 2 for that” when trying to reach your bank. Now imagine an AI-enabled system that revolutionizes the customer experience in the banking sector by providing personalized banking experiences and boosting productivity.

Sounds fantastic, right?

Time to embrace the game-changing power of Chatbots in banking—smart, intuitive solutions that replace outdated “press 1, press 2” systems with instant, personalized assistance.

These smart chatbots not only enhance customer experience but also free human agents to focus on complex issues, driving efficiency and transforming banking interactions at every level.

According to Gartner, by 2027, chatbots will serve as the main customer service channel for nearly 25% of organizations. A study by Bain & Company highlights that AI systems help banks cut downtime by 99%. Additionally, by 2026, chatbot interactions in banking are expected to exceed a 90% success rate.

These statistics underscore the growing importance of Chatbot in ensuring banks remain competitive and efficient.

If you want to develop your own custom chatbot for Banking, you can contact an AI chatbot development company which can develop AI chatbot in banking as per your needs.

What are Chatbots in Banking?

AI chatbots in banking Sector are tools that customers use while interacting with their banks without any hassle. These chatbots leverage the power of AI to simulate human conversation, allowing customers to get the help they need at all hours of the day.

An AI chatbot’s round-the-clock availability is one of its major advantages. You can use the chatbot to check your account balance, transfer money, or ask a question about any financial service. This instant support makes the overall banking more convenient by saving customers time.

Furthermore, Chatbot enhances the efficiency of banking operations. This is done by managing multiple queries, reducing wait times, and streamlining customer interactions. Eventually, this chatbot become smarter, learning from each conversation to provide more accurate and personalized responses.

Banks improve customer service with cost-effective Chatbot. This chatbot handles routine queries quickly, reducing the need for large support teams. They help banks serve customers faster and more efficiently allowing human agents to focus on complex issues, improving overall service quality.

Benefits of Chatbot in Banking

The financial sector is rapidly booming with Chatbots that offer multiple benefits to both banks and customers. These AI chatbot benefits include instant customer support, automated transactions, personalized financial insights, fraud detection, and enhanced security. Out of all the benefits, here are some of the major ones that come along with the installation of smart Chatbots into your banking systems.

1. Better Customer Support

Chatbots are available at all hours of the day. This way they provide prompt and quick responses to customer queries without the need to wait or navigate endless menus. This instant support builds trust and leads to customer satisfaction.

2. More Savings

Repetitive tasks like transactional updates and balancing inquiries can be handled seamlessly by Chatbots. By reducing the extra workload of human agents, Chatbots help them get more time to focus on other important issues. As per Gartner, companies using chatbots will cut customer service costs by $80 billion by 2025.

3. Improved Efficiency

Chatbots act as a catalyst to amplify routine banking processes like assisting a user check his credit score or navigating him through a loan application. This way banking bodies can efficiently process high volumes of customer interactions.

4. Personalized Financial Guidance

Chatbots review your spending habits and financial data to offer tailored advice—whether it is a savings plan that fits your goals or investment recommendations suited to your risk level. Think of it as having a financial advisor on standby, ready whenever you need it.

5. Always Available, No Waiting

During busy hours, customer service teams can only handle so many requests at once. Chatbots, on the other hand, can respond to thousands of queries instantly. No queues, no delays—just quick answers when you need them.

6. Increasing Productivity

Chatbots tend to automate repetitive and rule-based tasks. This way employees can get enough time to focus more on other crucial areas like strategic decision making or complex customer concerns. This way it leads to enhanced workforce productivity.

Use cases of Chatbot in Banking

With Chatbots, you get a wide range of services. Especially in the banking sector, Chatbot provides quality assistance in multiple scenarios. Banking chatbot is stepping up, keeping up with our fast-moving digital needs. Here is how they are making a difference in different use cases:

1. Transactions Management

Chatbot simplifies banking by helping customers make payments, set up recurring bills, and manage subscriptions. By sending alerts, they can notify customers regarding when a subscription is about to end. Chatbot also checks transaction history, provide real-time updates, and quickly find specific payments or errors. At the time of detecting any suspicious activity, they can flag and report it for further review.

2. Your Personal Banking Assistant

Need to check your balance? Block a lost card? Set up bill payments? Chatbots handle it all since they can be used as personal assistants. They can even analyze your spending habits and send reminders for upcoming transactions—so you never miss a payment again.

3. Support for Banking Staff

By handling simple customer requests smartly, Chatbots help find solutions to common problems so that people no longer need to put their energies into repetitive tasks. This leads to a higher retention rate. Additionally, these chatbots can collect information on user pain points that can be leveraged by employees to offer better services.

4. Helping you find the right Banking Products

Sales and marketing can be revolutionized with the help of smart and intelligent Chatbots. By analyzing customer’s transaction history, they can suggest specific services along with personalized recommendations on selected products or solutions. A chatbot can enhance the user experience when they decide to purchase a product.

5. Managing Payments made easy

From setting up direct debits to tracking transactions in real-time, chatbots take the hassle out of managing money. They can notify you about upcoming subscription renewals, flag unusual transactions, and even help correct errors before they become a bigger issue.

Real World Examples of Banking Chatbot

Chatbot in banking sector is a revolutionizing technology that has the potential to redefine the industry with its intelligent automation capabilities. These cutting-edge banking chatbots provide hardcore value via instant assistance and personalized interactions. Some prominent examples of Chatbots in banking include the following:

1. Erica – Bank of America

Bank of America’s AI chatbot, Erica, is changing the way customers manage their money. This voice- and text-enabled assistant keeps an eye on transactions, sends helpful alerts, and even spots ways to save. Need to pay a bill or check your account? Erica has it covered, making banking smoother and smarter.

2. Ally Assist – Ally Bank

Ally Assist, the digital assistant from Ally Bank, helps customers stay on top of their finances effortlessly. Using natural language processing, it helps users track accounts, pay bills, and track spending habits. Also, it answers routine questions and frees up human agents to focus on more complex issues.

3. Eno – Capital One

Eno from Capital One is like having a financial watchdog that never sleeps. It keeps an eye on your accounts, spots fraud, and sends real-time spending updates. Available through text, email, and the app, Eno even helps track subscriptions and create virtual card numbers for safer online shopping.

Challenges & Limitations of AI Chatbots in Banking

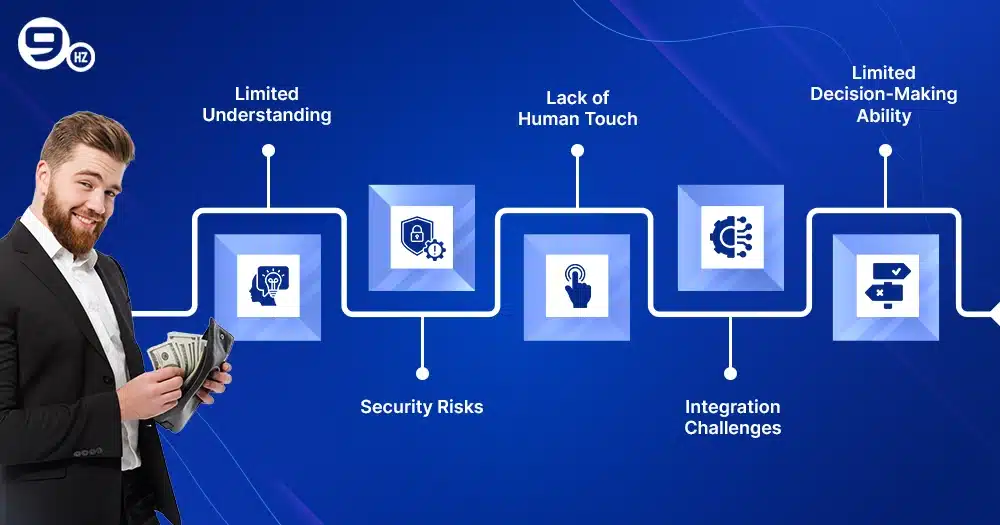

Whenever we have a new system to install, first we need to identify the challenges to deal with. The application of chatbots will vary depending on the specific difficulty your company faces. Here are the primary challenges of Chatbot in banking, have a look.

1. Limited Understanding

Ask a chatbot a simple question, and it might do fine. But throw in some slang, a tricky question, or anything slightly vague, and it panics. Suddenly, you’re stuck in a loop of irrelevant answers, and now you’re yelling at a bot that cannot hear you.

2. Security Risks

These bots deal with money. Your money. And that makes them a juicy target for hackers. If a chatbot is not locked down properly, cybercriminals can sneak in, steal data, and cause all kinds of chaos. Not exactly the level of trust you want from your bank.

3. Lack of Human Touch

Many customers prefer speaking to a human for financial concerns. Chatbots cannot express empathy or understand emotions, making them less effective in handling sensitive or urgent issues.

4. Integration Challenges

Banks need to ensure that Chatbots work smoothly with their existing systems. Integrating them with core banking infrastructure can be complex, time-consuming, and expensive. It takes time, money, and a team of tech wizards to make sure everything runs smoothly.

5. Limited Decision-Making Ability

While chatbots can provide general advice, they lack human judgment. They can suggest things, sure, but when it comes to real decision-making, a human still has to step in. No bot is deciding if you can buy that dream house.

Chatbots in banking have potential, but they are not magic. They can handle the basics, but when things get complicated, humans still run the show.

Learn more about the Chatbots of different industry:

What is the Banking Chatbot Development Cost?

Predicting a fixed cost to develop an AI chatbot is something that is highly subjective. This is because there are multiple factors attached to it. These factors include a number of features, product complexity, integrations, development methodology, and so on.

Additionally, factors like the development team’s location – whether it’s an in-house team, an agency, or an offshore partner, and the choice of deployment platform (mobile app, web portal, or both) also play a massive role when it comes to deciding the cost of AI chatbot development.

However, the average cost bracket to develop a banking chatbot starts from $25,000 and goes up to $150,000. Here is a table showcasing the banking chatbot development cost and timeline based on three different levels – Basic App, Medium Complexity App, and Advanced App.

| App Complexity | Average Cost | Average Timeline |

|---|---|---|

| Simple chatbot with basic features | $25,000 – $40,000 | 3-4 months |

| Medium complex AI chatbot with moderate features | $40,000 – $90,000 | 4-9 months |

| Highly complex chatbot with advanced features and integrations | $90,000 – $150,000 | 9-12 months |

How can The NineHertz help you with Banking Chatbot development?

What can you ask for more if you are getting an experienced chatbot development partner specialized in crafting robust, secure, and intelligent chatbots for banking and financial institutions, tailored to your unique business needs? A bang-on deal, right?

The cherry on the cake is that all of this comes at a very affordable price, making it a deal you simply can’t afford to miss. We have already built AI chatbots for multiple businesses, ensuring top-notch security and making us a trusted banking chatbot development company.

Our chatbots make life easier. They handle customer questions effortlessly, speed up processes, and even provide financial advice like a personal money guru.

Plug them into your banking systems, payment gateways, or fraud detection tools, and boom—everything runs smoother than a fresh jar of peanut butter.

No tech headaches. No nonsense. Just results.

If you think it’s too much, then it’s just the icing on the cake. Get in touch to see the whole picture. Contact us now!

Conclusion

The future of Chatbots in the banking sector is promising, thanks to shifts in customer demands. Whether you are a newbie, considering adding a banking chatbot for the first time, or are looking to switch providers, The NineHertz is there to be your digital transformation partner in the field of AI and chatbots.

Designed exclusively for banking, our chatbots give prompt and accurate AI-powered responses to customer queries. No wonder bringing AI into banking unlocks a gateway for an ocean of benefits and possibilities. By providing quick help, smoother processes, and personal touches, these smart chatbots transform the way customers interact with businesses.

Partner with us for cutting-edge artificial intelligence development services, and we’ll help you effortlessly build AI chat and voice bots featuring a user-friendly interface, automated workflows, and dynamic chat proposals, powered by Generative AI.

Frequently Asked Questions

How do Chatbots improve Banking Services?

Chatbots in banking revolutionize the banking sector by enhancing the overall customer experience. Using chatbots in banking reduces customer wait times by offering round-the-clock support and providing more accurate answers, making it more likely that customer issues will be resolved within the first instance.

Are Chatbots secure for Banking Transactions?

Yes, in order to protect sensitive customer data, Chatbots in banking are designed with strict security measures. With encryption, multi-factor authentication, and secure API, chatbots prevent malicious access. Further, compliance with financial regulations ensures data protection. In a nutshell, investing in chatbots in banking institutions is the need of the hour.

Which banks are using Chatbots?

Multiple renowned banks operating globally have integrated chatbots into their services to enhance customer experience and operational efficiency. Here are some famous examples:

- Bank of America: “Erica” assists customers with account details, budgeting advice, and basic transactions 24/7.

- Commonwealth Bank of Australia (CBA): CBA has built an AI agent who can assist business customers with queries, providing pointed responses.

- ING Bank: ING has developed a customer-facing chatbot using generative AI technology to meet customer needs.

- ICICI Bank (India): “iPal” aids with banking transactions and product information.

- JP Morgan: Utilizes AI-powered chatbots for customer support and fraud detection.

These implementations clearly depict the commitment of the banking sector to leveraging AI to enhance customer service and streamline operations.

What Technologies power AI Chatbots in Banking?

Modern chatbots rapidly use conversational AI techniques like NLP – Natural Language Processing to under user queries and automate responses to them.

Can AI chatbots assist with loan applications and approvals?

Yes, with automation AI chatbots can process the loan application from start to finish. By guiding applicants through each step, they ensure all necessary information is collected accurately and efficiently.

Great Together!