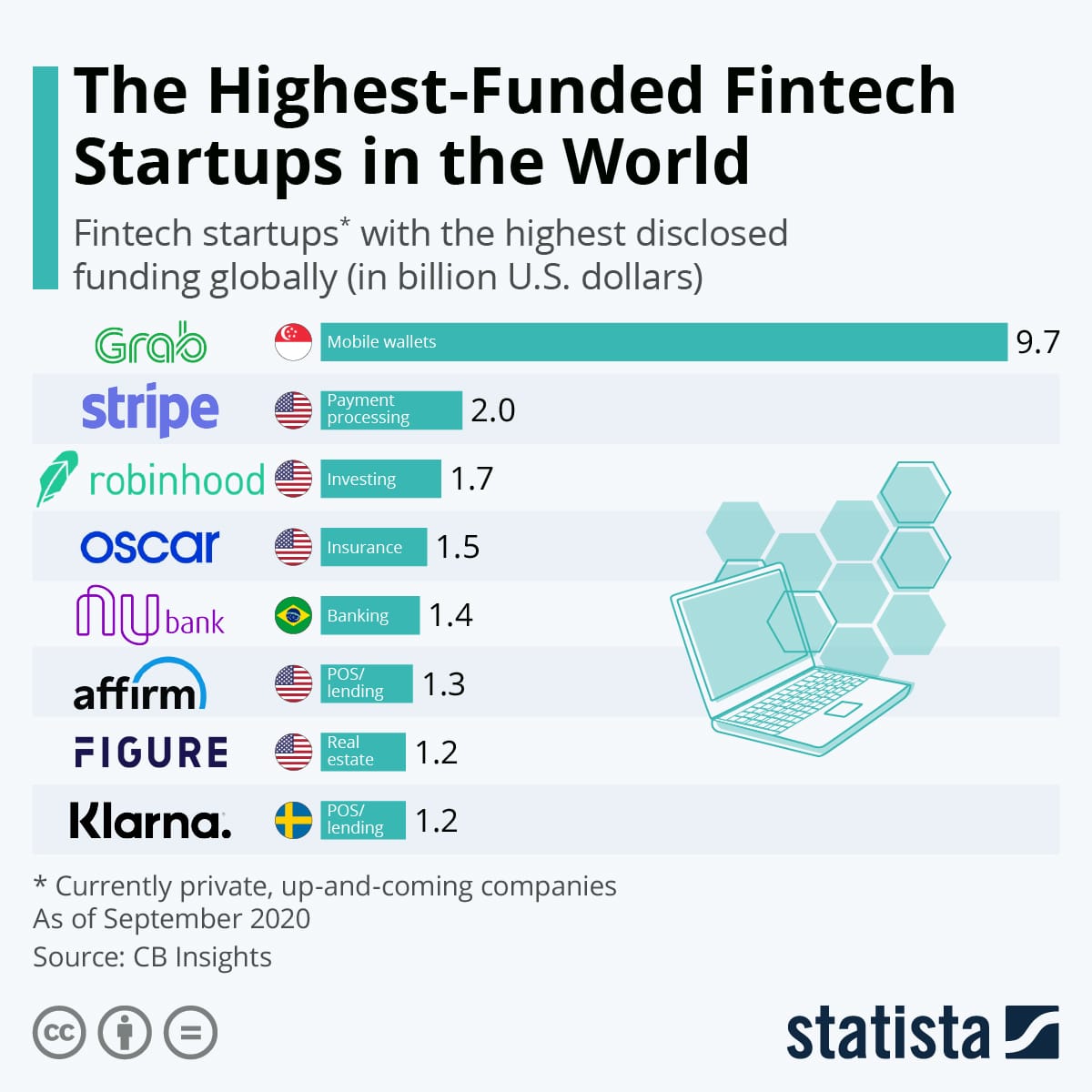

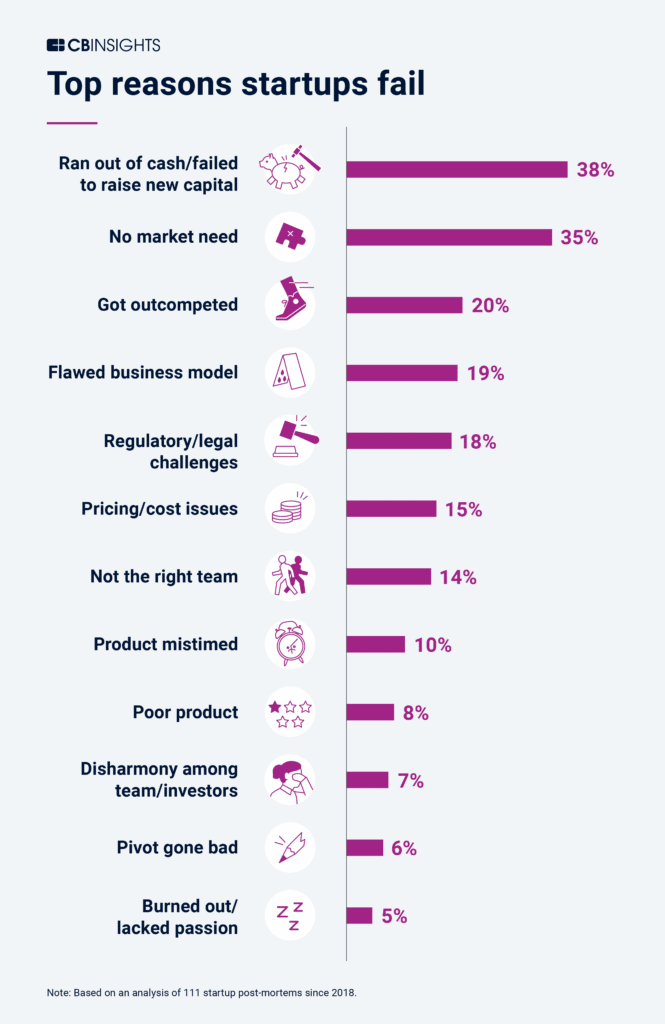

Looking for investors for your mobile app startup? Only about 10% of startups make it. Insufficient funds are the leading cause of startup failure (38%).

There are a number of things that can help you turn your app idea into the successful company you’ve always imagined. Apart from app ideas, you need a business and marketing strategy. And, most importantly, you need investors for custom mobile app development.

Source: https://www.statista.com

Finding and securing app investors is extremely important to its success. You can achieve this goal by learning a few tried-and-true tactics. So, in this article, we’ll go over how to find app investors for your startup.

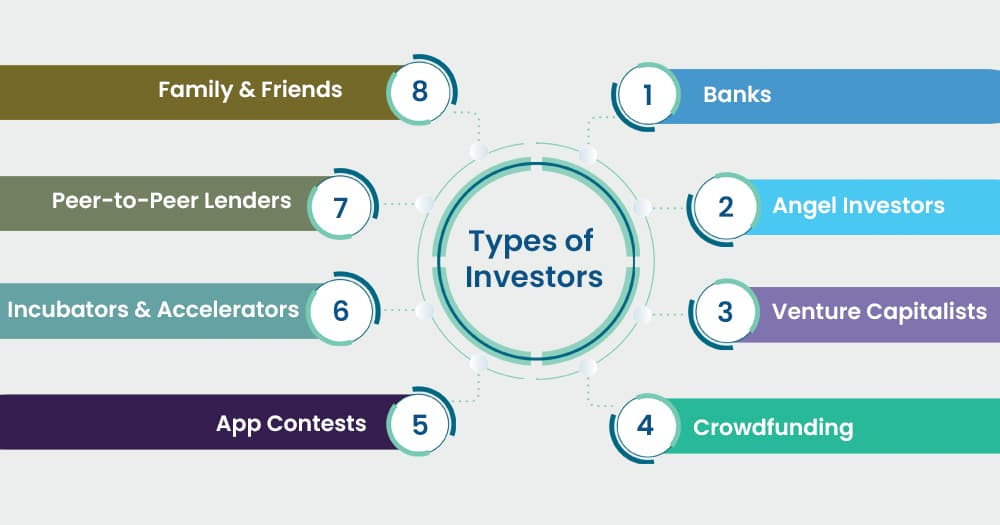

Types of Investors

Before looking for investors for app development, you must be aware of the type of investors existing in the funding arena these days. Investors can be required at practically any point in a startup’s life cycle.

Seven of the most popular categories of investors are listed below, along with suggestions for when they should be considered. To secure funding for your startup, you can reach out to the following potential investors for your mobile app.

1. Personal Investors for App Development

Generally, the investors of a startup in its very initial stages are mostly friends and family members. Thus, as an entrepreneur, you can rely on family, friends, or close acquaintances to invest in your startup, especially in the early stages.

Such personal app investors may or may not ask for equity while investing. The plus point is they may invest their own money in your business idea solely because they believe in you and your vision.

However, there are certain restrictions to how many of such individuals from your personal network can invest in a startup because of legal limitations. Apart from that, although convincing your personal network to invest in your startup may not be much difficult, extensive documentation is strongly advised.

2. Banks as App Investors

Bank loans have been a convenient source of startup financing for many years. You can opt for a bank loan for small businesses as taking a loan can give you more control over your startup’s financial decisions.

Many banks and financial organizations offer low-interest startup loans to new businesses. Before a loan application is granted, you may be required to provide proof of collateral or a source of income.

Even though the money lent isn’t as large as that provided through angel investing, it can be a good start for you if you believe your startup’s operating profit will be sufficient to sustain itself in the long run or if you want to jump-start your startup until you secure more money from an angel investor.

3. Peer-to-Peer Lenders

Peer-to-peer lenders are people or groups who provide funding to startups. This method to seek investment funding is also known as crowdlending. Entrepreneurs connect with these lenders to obtain loans directly from them through an online platform.

You must apply for peer-to-peer lending in order to raise capital for your startup. This method for seeking funding could be an excellent option for you if you need to raise funds for your startup but can’t get a bank loan.

4. Angel Investors for Mobile App

Angel investors are also known as seed funders. These high-net-worth individuals make early-stage investments in startups in exchange for an equity stake. Typically angel investors are found in every industry. Thus, an angel investor for app development can also be found.

Primarily, angel investors invest to make a profit as the company expands and its value increases. These angel investors not only provide financial assistance to early-stage firms but also provide valuable advice and networking possibilities.

Angel investing can be beneficial to you if your app startup has progressed past the seed stage, but you are not yet ready to seek a venture capital fund. On-point business fundamentals, a useful idea, and a perfect pitch are some of the factors that can attract angel investors.

You can reach out to angel investors directly online via emails, Linkedin messages, and other social media platforms, as well as offline at networking events with angel investors or through your personal network.

Source: https://www.cbinsights.com/

5. Incubators & Accelerators

Accelerators and incubators can provide crucial support for raising significant funds for your app startup. Business incubators are non-profit organizations that can help you incubate your app concept. They can equip you to lead your startup success in the long run by providing assistance in the areas of infrastructure, networking, advising, manufacturing, training, and coaching.

Although considering business incubators as mobile app investors is not a very compelling argument, their contribution will undoubtedly save you money, especially for tech startups in their early stages.

On the other hand, accelerators are for-profit businesses that offer fixed-term, cohort-based, mentorship-driven programs that include seed-stage funding, networking, and training. Accelerators receive a part of the startup’s equity in exchange for their services.

Many entrepreneurs prefer seed accelerators to angel investors because seed accelerators contribute much more than just seed-stage funding.

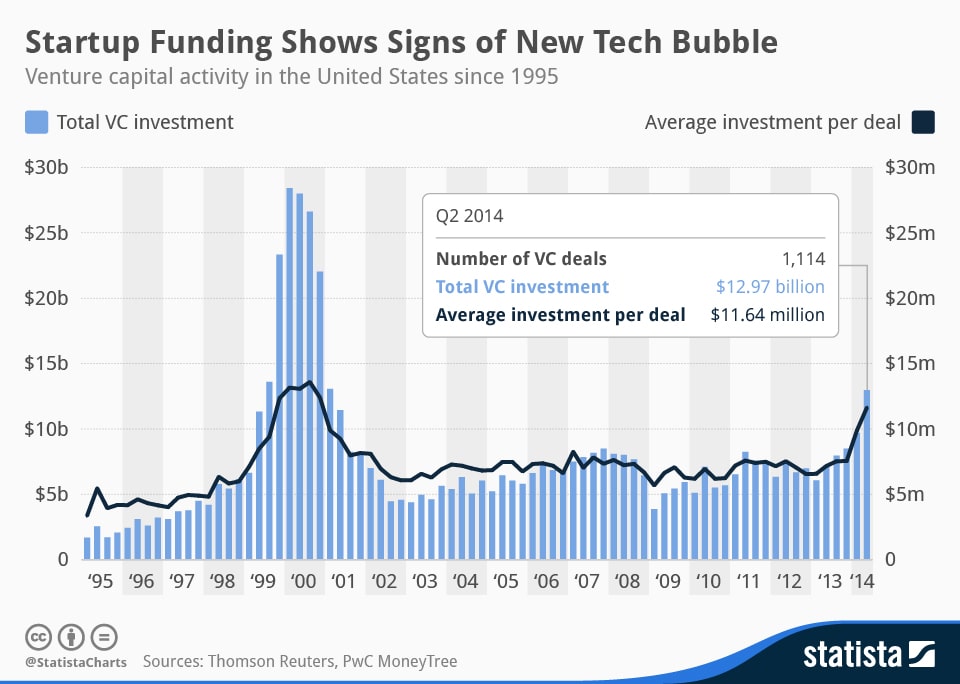

6. Venture Capitalists

Only after a mobile app startup has generated a large quantity of income does it turn to venture capitalists or venture capital firms. These mobile app investors are important because they typically provide substantial mobile app funding.

Venture capitalists or venture capital firms are actually high-net-worth people or corporations who invest in early-stage startups in exchange for a share of their ownership. Financing through venture capital focuses on entrepreneurs who have presented their innovative business ideas and their need for existence.

Aside from app development investment in monetary terms, a venture capitalist or venture capital firm can also provide guidance and direction to the technology companies they invest in, as well as participate actively in the decision-making process.

However, not all tech startups are successful in getting app funding from venture capitalists or venture capital firms. The venture capital funding process is lengthy because it includes many evaluations on the part of the app idea investors.

7. App Contests

To bring your mobile app idea from the idea stage to reality, you may have to turn to unconventional sources of startup funding for app. Entering pitch deck funding contests is one approach for an innovative mobile app to acquire awareness and raise money.

App contests or funding contests may help you raise money for your mobile app startup. Furthermore, these app contests might help you gain access to investors for the app development.

During such events, you will have the opportunity to present your idea to potential investors, acquire valuable exposure, and receive equally valuable feedback. Moreover, you will network with potential investors and other mobile app startups, but most importantly, you will have the opportunity to get mobile app funding.

Convert Your App Idea into Reality

Request A Free Quote

8. Crowdfunding for App Startup

Crowdfunding is a relatively newer way for entrepreneurs to raise money for their startup companies. You can raise funds through a funding campaign on one of the crowdfunding sites from a big number of people for your app funding. A plus point — you are not required to dilute your ownership equity.

These investors can invest in your startup in exchange for something — usually early access to your app, before its official debut in the market. You can also release a minimum viable product version of your app to get their feedback.

You may fix the minimum investment amount for your startup as well as some benefits that investors will receive.

How to Gain Trust of App Investors?

Regardless of the type of app investor you seek, your app idea and its presentation, as well as its potential and business plan, should make them trust your mobile app startup.

1. Aim to solve an actual problem

To be successful, your app idea must address a real problem or need that the users are experiencing. To persuade your potential mobile application investors, identify the problem and clearly illustrate how your app idea would assist in its resolution.

Also, the app’s potential users should be considered. This is because if it solves an issue for a limited group of individuals, they should be big spenders or influencers.

2. Validate Idea to App Investors

It is not enough to have a project idea before approaching prospective investors; you must also ensure that it has not yet been realized in the market. The objective of this discovery phase is to do this. At this stage, my other guide on how to patent an app idea might be helpful for you.

In the discovery phase, ensure that there are no similar mobile apps in the market or conduct research to find existing alternatives to improve your app. This may help you validate your app idea so that there are no surprises later.

3. Find the relevant market

Before moving on to the app features you want to add, you should first evaluate the app’s competitive environment — the offers of similar mobile apps in your market or simply services that may not be app-focused but are competitive to your soon-to-be product.

Once you’ll find out the relevant market for your app, you are more likely to strengthen your position and find any demand/supply gap in the market after your app’s launch, apart from being aware of your competitor’s strengths and weaknesses.

4. Define your app’s market size

Through market research, you can find out the size of the market by examining other competitive mobile apps. Define your target audience and market share so that you can give genuine numbers to your potential investors about the possible opportunities and threats.

Moreover, knowing the market size for your app will result in developing better pricing, distribution, and marketing strategies.

Discuss Your App Ideas With Us

Request A Free Quote

5. Know the investment fundamentals

You should know the basics of running a startup and startup funding to acquire the trust of your investors. This is where you’ll figure out what kind of funding you’ll need and what stages of investment you’ll need.

Moreover, the awareness of startup funding will equip you with improved organizational agility, better and faster decision-making, quicker problem-solving, and an increased rate of innovation.

6. Devise the revenue strategy

You should also work out a revenue-generating strategy once you have a firm grasp of the fundamentals of investing. The app investors will be more willing to fund your mobile app if you present them with a simple and clear approach. An effective strategy to generate revenue can serve as a competitive advantage.

It’s critical to research monetization methods and be prepared to answer any queries that arise. Traditional strategies include charging for the app, using a premium subscription, implementing paid add-ons, using in-app adverts, or a mix of these strategies.

7. Create an MVP or Demo App

You can create an MVP (minimum viable product) for your app. An MVP is a functional but working app without the entire functionality that a startup has envisioned.

Alternatively, you can create the demo version of your app. And what exactly is an app demo? — It’s a fully functional app that includes the majority of the future app’s features.

These options are suitable for investors who have a set budget but do not have funds enough for the complete implementation of the idea. These versions can allow investors to recognize your app’s potential and value proposition.

8. Practice your presentation

Now that you know how to obtain investors for your app development, it’s crucial to consider how you’ll go about doing it. Prepare for your pitch deck.

You should get to know every aspect of your startup thoroughly, be prepared to present it even without slides, and anticipate questions from prospective investors for your mobile app. Half of success is having faith in your idea, app, and pitch deck.

Let’s take a closer look at the various stages of funding throughout the startup lifecycle.

Funding for Mobile App

1. Pre-Seed Funding Stage

The pre-seed funding stage often refers to the time when an app startup is getting its operations up and running. The time to get startup funding for your idea depends on the type of your startup and the initial costs going into your app development.

Bootstrapping is the term for the pre-seed stage. To put it another way, scaling your startup implies utilizing your existing resources, such your own savings.

The pre-seed stage enables tech startup companies to efficiently create and distribute their apps. Entrepreneurs often analyze the viability of their idea throughout the market research or development phase. They may already have a functioning prototype of their app and be looking for money to help them scale their startup.

Many entrepreneurs seek advice from founders who have been there and have gone through a similar experience as them at this point. It enables them to calculate the costs of their idea, create a winning business plan, and brainstorm ways to turn their concept into a viable business.

During the pre-series stage, entrepreneurs should sort out any necessary partnership agreements, copyrights, or other legal concerns, as compliance issues are best settled during this stage. Otherwise, they may become costly and perhaps exorbitant in the future. Furthermore, no investor will back a startup that has legal concerns before its launch.

2. Seed Funding Stage

It’s time to actually plant the seed after the pre-seeding stage. The seed-stage can be compared to the act of planting a tree. This startup funding in the seed round is, in theory, the “seed” that enables every app startup to grow.

Continuing to invest your own money in your startup could be risky. Thus, entrepreneurs reach out to investors. As investors take big risks by investing in a startup, entrepreneurs provide them equity in exchange for seed money. The risks are considerably higher because entrepreneurs can’t guarantee a successful business plan at this stage.

The seed round capital enables a startup to cover the costs of app development, get early traction through marketing, begin hiring, and conduct additional market research in order to achieve product-market fit.

Many companies believe that the seed round is all they need to get their startup off the ground.

3. Series A Funding Stage

The initial round of venture capital funding is known as the Series A stage. By this point, the startup has a working app and a steady stream of money.

It’s now time for them to pursue series A funding and improve their value propositions. This is a fantastic chance for entrepreneurs to expand their reach into new areas.

Many times, entrepreneurs come up with innovative app ideas that can attract a large number of eager users, but they are unsure how to monetize them in the long run. Thus, it’s critical to have a plan in place for the Series A investment round that will generate revenue for the long term.

This is the time to start studying startup funding and developing networks with angel investors and venture capitalists. You must find app investors who might be interested in investing in your firm using the 30-10-2 method. This rule states that you must find 30 investors willing to invest in your startup.

Early-stage venture capitalists and angel investors provide the majority of Series A investment. They are not searching for “amazing app ideas,” but rather for businesses with a solid business model that can transform their amazing app idea into a successful, profitable firm, making investors profit from their investment.

A single investor can operate as an “anchor,” but after a startup has attracted its first investor, it becomes easier to attract investors thereafter.

4. Series B, C, and D Funding Stages

App startups that have progressed through the previous stages of funding may amass a sizable user base and a continuous stream of revenue. They may have demonstrated to their investors that they can succeed on a broader scale.

The series B investment stage allows app startups to expand so that they can address the diverse needs of their users while also competing in competitive marketplaces.

A new wave of venture capitalists enters the series B stage. These venture capitalists specialize in investing in well-established firms so that they may continue to exceed expectations.

Further, app startups that reach the series C investment round are well on their way to success. These app startups are looking for additional investment to help them develop new apps, expand into other areas, or even acquire other underperforming mobile apps in the same field.

Investors prefer to fund successful startups in the series C investment stage. They expect to make a profit that exceeds their initial investment. During the Series C stage, several hedge funds, investment banks, and private equity firms can also invest in these startups.

Further, entrepreneurs might find investors to raise funds for a specific situation during the Series D funding stage.

This is a stage that few startups need such as a merger or a growth target.

Series D capital provides entrepreneurs with the most viable options, allowing them to confront difficulties head-on by merging with another startup. In addition, if a startup is unable to reach its growth milestone with series C funding, it will need to seek further capital through series D funding to stay afloat.

How Much Investment Require for Mobile App?

Consider some of the most recent things you’ve purchased. There are varying price points depending on specific factors, whether it’s a vehicle, a kitchen appliance, or a maintenance service.

So, how much funding do you require to create an app? A predetermined fee for developing a mobile application does not exist. The price of the app will be determined by a variety of criteria.

The cost of labor, such as remote app developers, maybe the most important factor in determining the cost of developing an app. Apart from this, customer acquisition costs, building platforms, testing costs, and hosting costs also contribute to the mobile app development cost.

Building an app requires significant time and financial investment. The average annual investment total varies as per the complexity of the app from $2000 to $25,000.

However, the price you’re given up front doesn’t tell you everything. There are many factors that go into effective app development.

How much funding for your app falls inside this price range? Continue reading.

Cost to Launch a Mobile App

| App Type | Development Time | Cost |

|---|---|---|

| simple app | 40 to 160 hours | $2000 to $4000 |

| medium app design | 150 to 350 hours | $5000 to $9000 |

| complex app design | 600 to 1000 hours | $10,000 to $25,000 |

These prices are determined by the length of time it takes to build the app and the hourly rate charged by the app developers. The majority of these costs also cover the cost of designing the app.

For instance, designing a simple app might take 40 hours to even 160 hours. It might cost $2000 to $4000 for a simple app design. Whereas, a medium app design might consume 150 hours to 350 hours and cost $5000 to $9000. On the other hand, a complex app design can take 600 hours to as long as 1000 hours. It might cost $10,000 to $25,000.

Experienced mobile app development company in USA can help you get an estimate for designing your app. You may consult such a firm and they will offer you an exact quote based on your specifications.

App Development Process

The process of mobile app development is divided into 3 parts — Front end App Development, Defining Backend Development and API Integration.

1. Frontend App Development

It is critical to creating an interactive user interface for the front end. Even though some apps require working without the internet in many circumstances, local data storage is required.

It is proposed that a dynamic and engaging frontend be designed to make the mobile app usable for everyone. Only the ideal combination of frontend and backend can make an app interactive and usable for the end-user.

2. Defining Backend Development

The frontend app experience is improved through backend development. To support your app’s functionalities, the mobile app backend includes database and server-side objects.

3. API Integration

Custom API development and integration ensure that the app works properly for a given system. Custom software solutions and APIs allow programs, data, and devices to communicate with one another.

Best Way to find App Investors?

Apart from traditional funding sources like family, friends, and bank loans, venture capital firms and angel investors are no longer the only sources of funding for the app. There are a variety of possibilities for getting your startup funded, including unconventional methods like crowdsourcing and peer-to-peer lending. Some of these options, however, are only available once your app is somewhat complete. So, make sure you understand what your startup requires (and deserves) in order to make your startup investment decision easier after finding investors for the app.

FAQ’s

Q.1 How do I get investors for my app?

To get the best investors for the app, you should look for different options below mentioned.

- Bootstrap Your Way Up with Co-Founders

- Set up a Crowdfunding Campaign

- Raise Donations on Your Own Site

- Participate in Funding Contests

- Angel Investors and Strategic Partners

Q.2 How much does it cost to start an app?

The short answer is a mobile app can cost up to $10,000 to $500,000 to develop, but your mileage may vary depending on app requirement.

Q.3 Do you need investors to start an app?

Yes, investors can turn your idea into reality as without appropriate funding, your idea for that great app will remain just an idea. Following are the benefits of having an investor to start an app.

- Better customer service and support

- Brand reputation and networking

- High market value and easy payments

Q.4 Is investing in an app a good idea?

Yes, investing is totally good as it has several perks mentioned as below.

- Reach a global audience

- Millions of people download apps every single day

- Build brand awareness locally and globally

- Increase customer engagement

- Increase sales and revenue

Q.5 How much funding do you need for an app?

The average amount needed is $40,000–$60,000 when estimating the funding for an app , but there are many other elements that might affect the amount needed. If you want a complex application with multi easy to features then it would require around $150,000–$300,000.

Great Together!