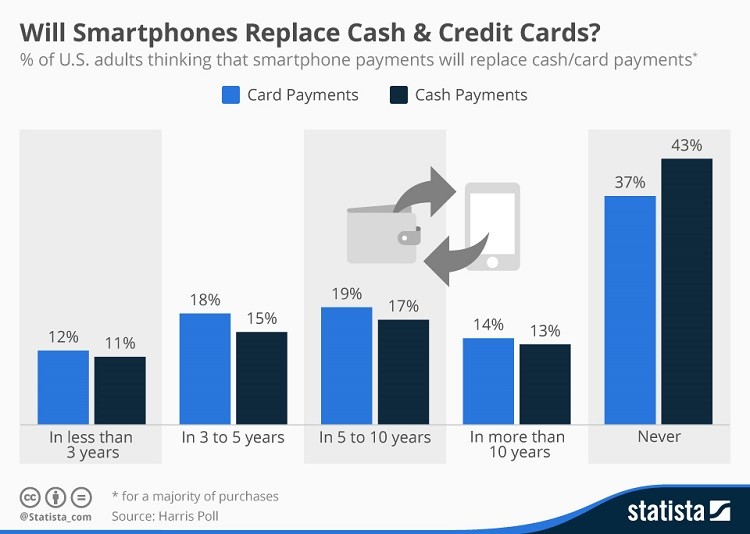

As per a survey conducted in the year 2015, 39% of respondents made payments through mobile devices in the USA. The company conducted the same survey in the year 2016 in which 32% of respondents used online payments and digital wallets. Wherein, 78% of consumers were aware of them.

Source: Statista

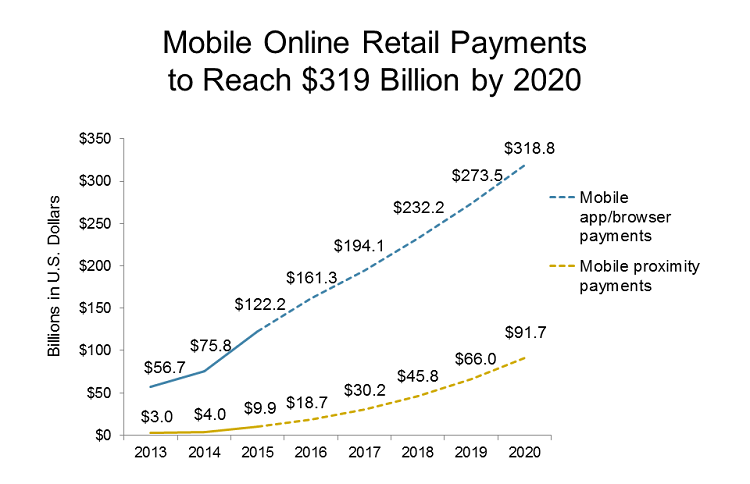

Another survey conducted in the year 2017, digital payment apps for e-commerce stores were the most popular ones with 63% usage rate among total mobile buyers. Juniper Research states that a 32% hike is expected in the money spent via a mobile wallet.

As per a report generated by Statista, the revenue of the global mobile wallet market has risen from 450 billion US dollars to 780 billion US dollars. Experts also predict the growth up to more than 1 trillion in the year 2019.

What is a Mobile Wallet?

An ordinary wallet stores cash and a mobile wallet stores card information and cashless money.

The digital mobile wallet is used to store multiple card details, digital currencies like bitcoin, loyalty cards details, membership cards of business or club, etc. Doing any transactions through digital wallets and mobile wallets is easy. The stored details can be used later with no need for physical access to the card.

Mobile wallet apps are used at the time of online shopping, online bill payment, etc. The user can also pay when he or she visits a retail shop. These payments can be made using a registered mobile number or QR code.

Users can use and redeem discount coupons that are stored in the mobile wallet as required. It is essential to consider all of these functions while developing a mobile wallet app.

Want to Create Your Own E-Wallet App?

Request A Free Quote

Which Industries can Benefit From Mobile Wallet App?

As mentioned above, the user can use a mobile wallet app anytime and anywhere; required the service providers are offering the facility to do so. As mobile wallet payment is becoming favorite day by day, numerous industries can benefit from it such as:

Retail-

The retail shop owner can offer a QR code to users to pay bills. Retail shop owners get an immediate message from app about the successful transaction.

Source: Javelin

Healthcare-

It is a typical case that patients or their relatives might run out of cash and hence, mobile wallet app for bill payments is a plus point for hospitals, chemist shops, and users too.

Telecommunication-

What if a user wants to make an important payment and runs out of balance? These mobile wallet apps are great to help in such situations as the user need not go to a shop and recharge by paying cash. The user can merely recharge through mobile wallet apps.

Uses of Mobile Wallet Apps

- Online commerce payments- This is when users perform any online shopping and pay online for goods/services. Here user also gets a receipt of the payment.

- Mobile P2P money transfers- Some famous apps such as Google PAy, Venmo and ClearXchange allow users to send and receive money through mobile. The amount can reach up to even 1 billion US dollars. These apps also provide money transfers from a linked user’s bank account to another one.

- Point of Sale (POS) payments- The POS payments occur at the storefront. The user can pay the amount using mobile/contactless technologies.

There are 5 ways in which POS payment can be made:

- NFC

- Bluetooth and iBeacon

- QR Codes

- Payment Apps

- Wearable Devices

NFC-

NFC, i.e. Near Field Communication Protocol allows contactless money transfer between an NFC-enabled smartphone and a transmitter attached to a POS device. NFC uses a card emulation technique to store card details in a digital form in the mobile wallet. It retrieves user’s payment information automatically and transmits it via NFC to the payment terminal during payment.

If data is stored, the user need not connect to the internet. NFC uses EMVCo or tokenization technologies while developing a mobile wallet for iOS. To develop an Android mobile wallet app, NFC and HCE technology are the best options.

Bluetooth and iBeacon-

iBeacon technology is an excellent way to transfer data, and it does not require internet. Smartphone with Bluetooth can communicate with an external BLE transmitter, i.e. beacon. POS terminal fetches the necessary details stored in the mobile wallet of the user through beacon devices and Bluetooth technology. It makes shopping simpler for shoppers.

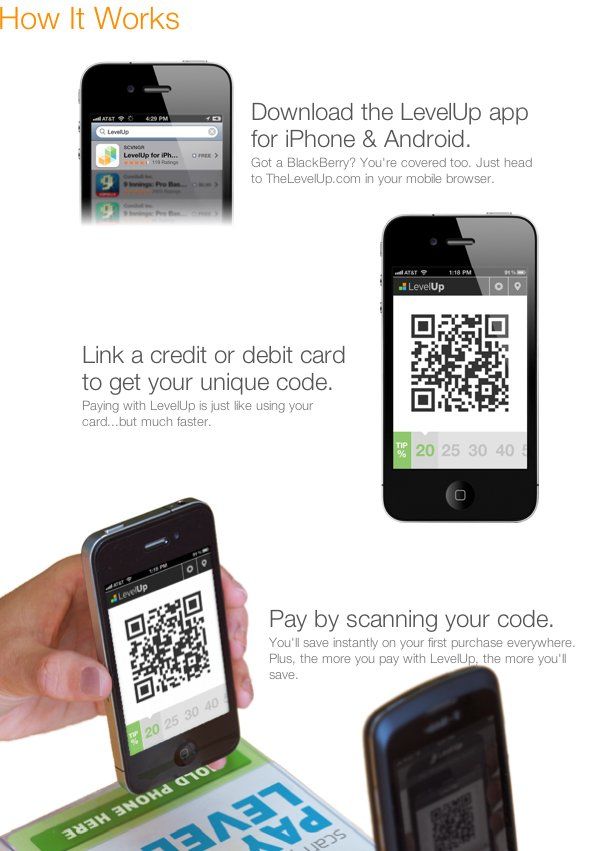

QR codes-

The alternate option to NFC is QR codes. The user needs to point camera through an app on the QR code to complete the purchase transaction. The LevelUp app; an American mobile payment app also supports QR payments.

How LevelUp App Works

Payment apps-

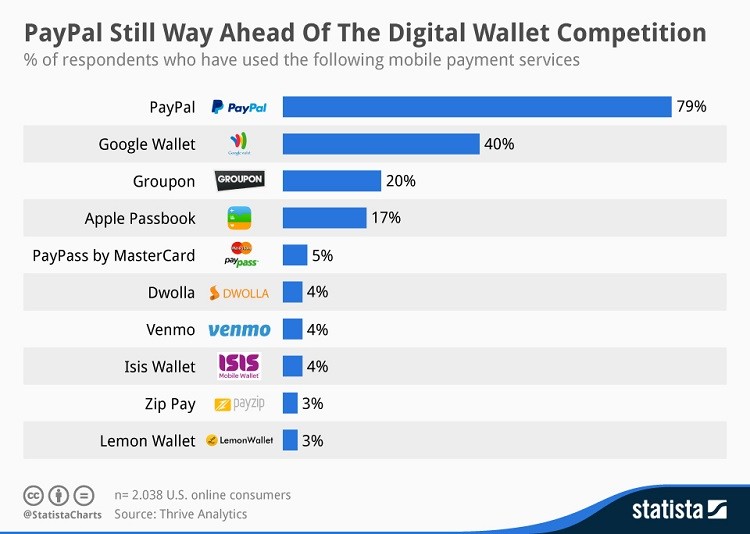

The primary function of payment apps is to make payment easy. These apps partner with local merchants and support all type of payments. PayPal, Android pay, Apple pay are the favorite payment apps which are expanding their network offline to offer better payment options.

Source: Statista

Wearable devices-

Many apps like Apple pay are planning to support wearable devices through NFC chips. As per the latest news, TD Bank Group and MasterCard recently collaborated with a well-known wearable device making company Nymi to build World’s First Biometrically Authenticated Wearable Payment Using Your Heartbeat.

Hire Digital Wallet App Developers

Request A Free Quote

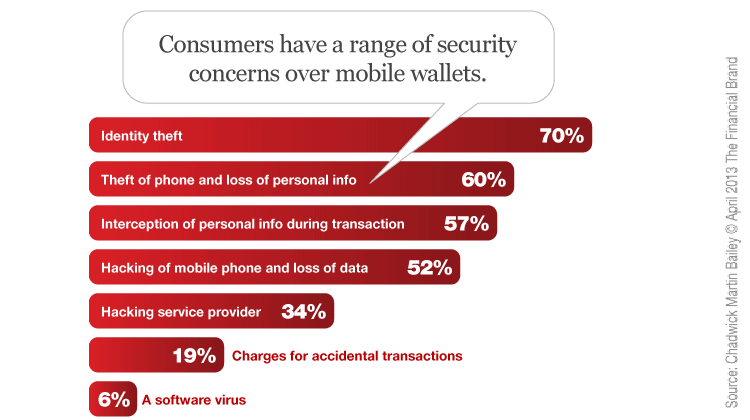

Why mobile wallet security matters?

Developers need to focus more on the security of mobile wallet app because of mobile payment wallet app store all bank details. A significant concern in users before downloading and using mobile wallet apps is the fear of security breaches. Developers pay colossal attention to security and breaches so that no account details are stolen or leaked at the time of the transaction.

55% of respondents from a survey stated that they are afraid of making online payment as they are worried about security.

Point to point encryption can be a great help in making all transactions secure since it encrypts the whole transaction. Also, bio-metric protection can be helpful in offering security to the mobile wallet apps.

As we can see the market for mobile wallets is going to see more hike in the future, it is essential for mobile app development companies to focus on these apps.

To understand how to develop a mobile wallet app, let us read further.

#1. Allow users to create own profile:

The developer should offer each user an option of creating a unique profile. The user can store all the details such as name, mobile numbers, address, bank details, transaction details, etc. in the profile. This feature plays a vital role as it offers personalized service and ease in accessing the app.

#2. Let them sync more than one bank details:

There is a possibility that user might have more than one bank account. The app must have the option of syncing bank details of more than one bank. Developers need a tie-up with all the banks to proceed with this functionality. Initially, developers can collaborate with big and famous banks only.

#3. No minimum transaction rule:

An excellent mobile wallet app allows users to transfer even 1 dollar. It depends on the app development services management to decide what should be the maximum limit of the transaction. There is also a maximum transaction limit.

Imagine your user is buying some fruits and is not carrying cash. The vendor has an option of mobile wallet payment. The bill is 2 dollars. The user should be able to pay a small amount like 2 dollars to the vendor. This feature is the most liked feature by users.

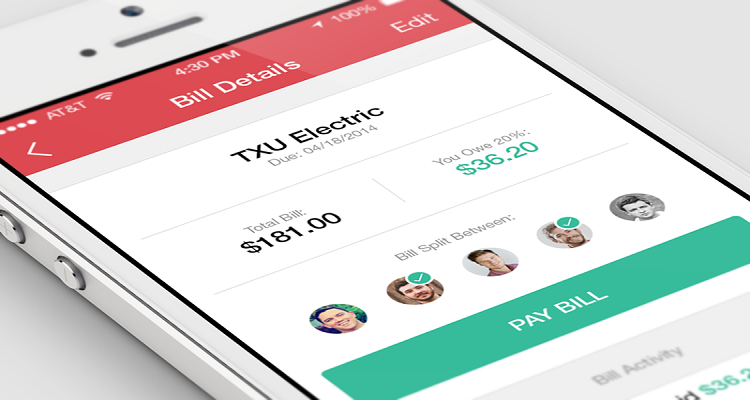

#4. Split bills option:

Some advanced mobile wallet apps are offering a feature of split bills. The user needs to add profiles of other users and add total bill amount. the app then splits the amount. App also notifies the other group members. This feature is best suitable for college going crowd and students who usually follow same bill split formula.

#5. Let them use without adding bank details:

Many mobile wallet apps have not made it compulsory to sync bank details with the app. What if anyone wants to use the app but does not have a bank account. In such cases, the user can use the app but cannot transfer money to the bank. Only if another user sends money to this user, then the only user can use that much of amount for transactions.

#6. Let them send money to those who are not using the app:

What if you want to send money to your father through the mobile wallet and your father is not using a mobile wallet. Don’t worry. Do you have his bank account details like name of the person, account number, bank name, branch name, IFSC code, etc.? User needs to put these details in the app. All e payment apps have an option called transfer money to the bank account.

#7. Receipts:

Every user must get an acknowledgment in the form of digital receipt. When you visit a restaurant, after paying the bill, the manager gives you a receipt. When you buy something from a shop, the shop employees give you a receipt of payment. These receipts are proof of transactions.

No matter transaction was successful or not; the user must get an acknowledgment about it. In the mobile wallet app, the user gets a digital receipt of every single transaction. The receipt has details such as amount transacted, date of the transaction, time of the transaction, sender details, receiver details, etc.

#8. Reward points:

Have you ever got any notification from mobile wallet apps about rewards or discounts? The apps offer a certain percentage of discount to the users after a payment transaction.

Like this, top app developers can offer such rewards, discounts, etc. many apps offer free vouchers if the user transfers a particular amount or more.

Conclusion

Gone are the days when people used to pay bills by visiting the bill payment centers. That process was too hectic and required much time. Ever since the USA has become digital, people have started paying bills online. The mobile wallet market is seeing a great hike.

Hence, developers must consider this market and start developing a mobile wallet app. Developers must take care of security issues, offer various features like reward points, split the bill, syncing more than one bank details, etc.

Great Together!

![Developing Mobile Wallet App for Digital Solution [Cost and Features]](https://theninehertz.com/wp-content/uploads/2018/09/Mobile-Wallet-App.jpg)