Some emergencies don’t wait for your monthly paycheck and you might need a certain amount in the middle of a month. In a situation where asking friends or family doesn’t seems to be a great idea, there are some best cash advance apps no direct deposit required that can save your ship. These apps basically give you some amount with minimum or no extra charge which you can repay after receiving the salary or payment. No direct cash deposit is required in these instant cash apps which makes the process even easier. However, in order to ensure that you choose a reliable and genuine platform, we are hereby listing the 15 best cash advance apps that can give you good monetary help during an emergency without claiming any unreasonable interest.

According to statistics, the global merchant cash advance market size was valued at $620.3 million in 2021 which is all set to achieve the valuation of $1.7 billion by the end of 2027. The market is expected to show a CAGR of 19.33% during the forecasted period which makes it one of the fastest-growing segments around the world. Owning to this growth and reliability of people, there are a lot of fraudulent software and apps in the market which do nothing but steal user’s personal data. So, it is important to rely only on the cash advance apps like Dave for safety and usefulness.

What are Cash Advance Apps and How Do They Work?

If you are looking for mobile app development services, The Ninehertz is one of the best mobile app development companies in USA. As the name suggests, these are the digital software, applications, and platforms that enable users to borrow a certain amount in time of emergency and return the amount once they have received their paycheck. The core difference between cash advance apps and traditional credit card loans or personal loans is that they don’t charge you any interest. Rather, they more rely on the subscription model or ask the users to pay the tip for the convenience they have received through the software.

One of the core benefits that these best cash advance apps offer is easy accessibility to advance cash and financial help without much formalities, paperwork, and interest on the principal amount. At the same time, the amount also depends on the user behavior and capability that can be altered by the application. Returning the money is also very easy. Additionally, discover the best money-making apps to enhance your financial resources.

Users have to make a few taps to borrow the amount and thus they don’t either need to take the heavy loan without any need. One can just borrow any amount at any time to prevent the heavy charges and mismanagement of their finances.

10 Best Cash Advance Apps in 2026

Discover applications, including some new cash advance apps in the mix! These apps offer quick access to funds, making it super easy for you to get the money you need. Stay ahead by trying out these cool apps that make managing your cash simple and efficient.

| Sr.No. | Name of the App | Price | Pros | Cons | Compatibility |

|---|---|---|---|---|---|

| 1. | BrigIt | $9.99-$14.99/month | – Borrow money quickly – Track your credit score – Connect with bank accounts |

– Not affiliated with any loan app – Some features are adhered to paid plans – Not all users are eligible for loans |

Android and iOS |

| 2. | EarnIn | Free | – Balance shield alerts – Free credit tracking – No cost options to borrow money |

– Charges for instant transfer – Third-party fees might be applicable |

Android and iOS |

| 3. | Empower | Free | – Instant cash from $10 to $250 – No mandatory minimum or maximum due date timeframe – No interest |

– Not everyone will qualify for a Cash Advance – Instant delivery is optional |

Android and iOS |

| 4. | MoneyLion | $19.99 per month | – Get cash advances up to $500 – No credit check or interest – Compare offers for personal loans |

– Cash advances limited to $250 – Subscription fee of $8 per month. |

Android and iOS |

| 5. | SoLo Funds | The interest of 15% of the borrowed amount | – Access up to $575 before paycheck – SoLo Funds is a Certified Public Benefit Corporation |

– Can only borrow smaller amounts for a short period – Loans aren’t guaranteed |

Android and iOS |

| 6. | Payactiv | Free | – Up to 2 days early deposit of your paycheck – Transfer funds by phone number – Track your spending habits at a glance |

– Instant funding requires a Payactiv card – Program fees of up to $5 per pay period |

Android and iOS |

| 7. | Rufilo | Free | – The app is legit for only small offers – The least formalities to get a loan |

– Borrowing eligibility depends on the earnings and profile of the user | APK version |

| 8. | Varo | Free | – Get a credit-building card with no security deposit – No APR or annual fee |

– Rates may change at any time without notice | Android and iOS |

| 9. | Dave | $1 per month | – Early access to direct deposit funds – Repayment between 3 days- 3 weeks |

– Doesn’t allow you to overdraw from your account – Limited ways to deposit cash |

Android and iOS |

| 10. | Chime | Free | – Get paid 2 days earlier – Trusted by millions of users |

– ATM withdrawal fee might apply | Android and iOS |

15 Free Instant Cash Advance Apps No Direct Deposit Required

Let’s Know about best cash advance apps no direct deposit required in detail.

1. Brigit – Best Cash Advance App

Brigit is one of the best instant cash advance apps that provide you a sum of $250 whenever you need it. The best thing about this app is that the application will not ask you for a tip out of nowhere. At the same time, the documentation and formalities on this application are also very limited. However, you must note that user has to take their paid plans in order to leverage the advance cash facility.

Brigit comes with different paid plans according to the requirements and usage. The Plus plan costs $9.99 per month and includes the features of a free plan, overdraft coverage, plus cash advance, and credit monitoring. Another one is the Premium plan that costs $14.99 per month which consists of all the free and plus plan features along with a credit builder loan and express free delivery facility.

Core competencies

- No credit check for advance cash

- No late fee on borrowings

- Multiple paid plans according to requirements

- Inbuilt Spend monitoring

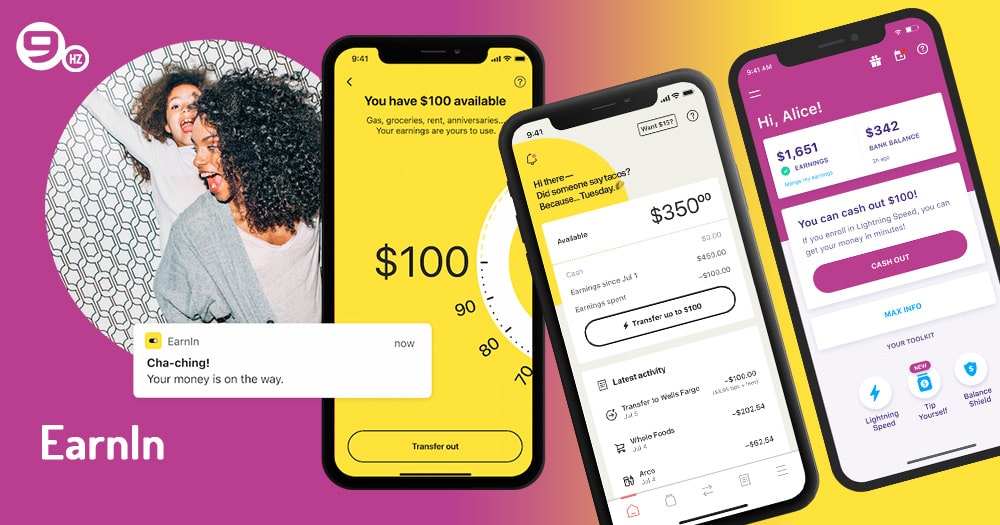

2. EarnIn

With their slogan, “It’s payday all day, every day” Earnin is one of the best cash advance apps for users who want to access their paycheck before the payday. The application is available on the Apple App Store as well as the Google Play Store for better accessibility for users. One can transfer $100 per day with a total limit of $750 for every pay period.

There are no mandatory fees that you have to pay to leverage the services. At the same time, EarnIn doesn’t even check your credit score or history to lend you the money. All it takes is just a minute to send the money to the linked bank account. However, the balance might take 1-3 business days to reflect in your bank account. Also, explore the world of best money making games to enhance your income opportunities.

Core competencies

- Instant payout request in a few minutes

- No mandatory fee or credit check

- 5M+ downloads

- Partnered with Bank of America

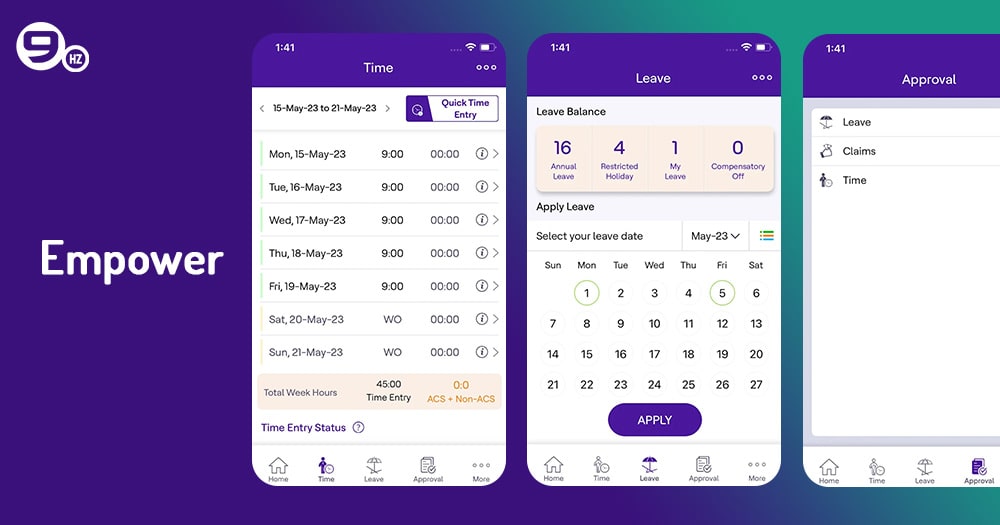

3. Empower

Empower is another best cash advance app that offers cash advances, bank accounts, and budgeting tools. The funding time at Empower is one of its competitive offerings as it transfers the funds very quickly as compared to the competitors. At the same time, users can pay the delivery fee to get the funds within an hour during any emergency.

Moreover, Empower also offers an automatic saving feature that sends a particular amount of your paycheck to the savings account. One can also use the artificial intelligence feature to save money by moving the funds from checking to savings on a weekly or monthly basis.

Core competencies

- Advance paycheck of $10-$250

- Fasting funding fee to get instant money access

- Automatic repayment from the account on the due date

- The least time to transfer the funds

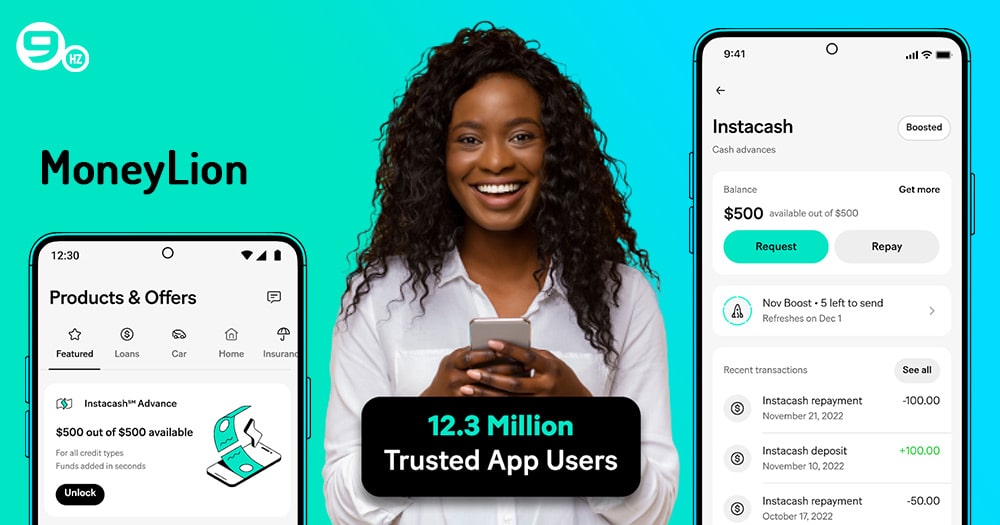

4. MoneyLion

Along with an advance cash withdrawal of $500, MoneyLion comes with a range of other features like credit-builder loans, financial tracking, investment accounts, and much more. The cash is available to anyone who qualifies for the checking account. Moreover, being a MoneyLion member, one can leverage the benefits of the fastest funding times and larger advances. Explore the world of how do free apps make money to understand diverse income-generation strategies in the app industry

MoneyLion even offers an advance withdrawal limit of up to $1000 to the users who also register for the additional features. The member fee for the app is $19.99 per month. For fast funding, users have to pay anywhere between $0.49 to $8.99 per advance.

Core competencies

- Money can be withdrawn within a minute

- Fast rewards up to $500 per qualifying purchase

- Round Ups features to invest the spare change money

- Compare offers for personal loans, online loans, small loans, & savings accounts

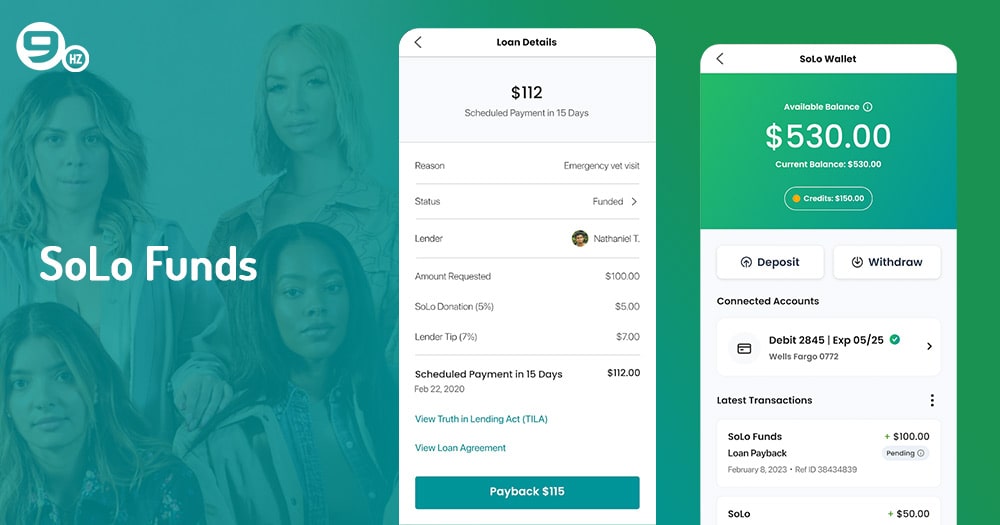

5. SoLo Funds

SoLo Funds operates on a totally different business model where it facilitates peer-to-peer cash advance facilities. The users can send the loan request on the app’s marketplace and the registered lenders on the application can choose the user they want to lend the money. This application has comparatively lower interest rates or fees which are mostly optional. At the same time, user can choose the repayment date according to their particular preferences. Also, check out making money with NFT games for some fun and profit in the world of non-fungible tokens!

One of the drawbacks of using SoLo Funds for advance cash is that it takes 3 days to confirm whether your loan request will be accepted or not. So, one might not rely entirely on this application when looking for emergency financial help.

Core competencies

- Peer-to-peer funding

- Flexibility of choosing repayment date

- Option tip feature

- Optional donation

6. Payactiv

With over 500K downloads on the Google Play Store, Payactiv stands as one of the best cash advance apps. You can get early access to your paycheck whether you receive a salary from a private firm or any government department. Moreover, the users can choose their paycheck to directly credit to their Payactiv account to clear all the dues as well as pay the rent, bills, and all other expenses.

Other features of Payactiv consist of receiving and sending funds to other members, making transactions from phone numbers, and getting financial help instantly. The competencies like no minimum balance requirements, no overdrafts, and no monthly or inactivity fees make it one of the best choices among the free instant cash advance apps in the market.

Core competencies

- Early access to paycheck

- Free integrated bill pay feature

- Surcharge-free withdrawals at 37,000+ MoneyPass® ATMs

- Spending habit tracker

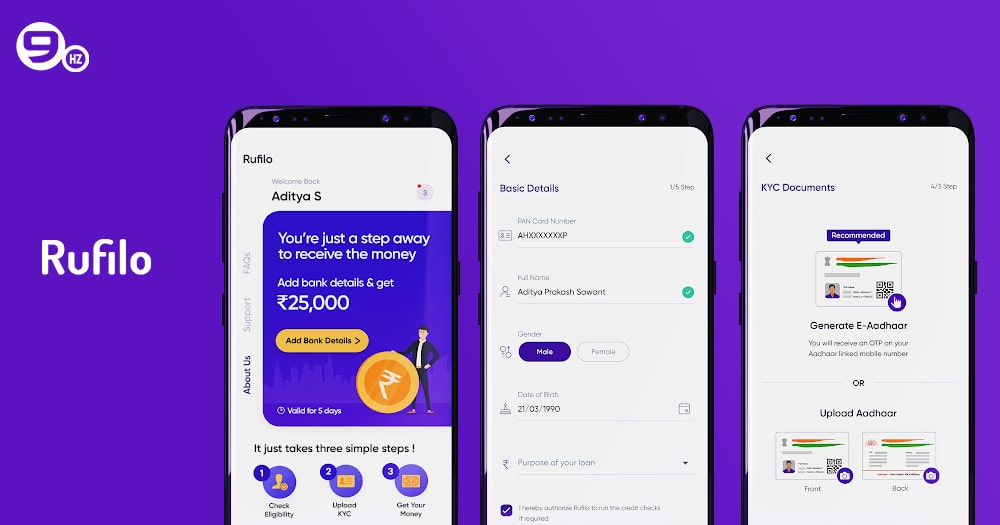

7. Rufilo

Rufilo can be your choice among the best cash advance apps like Dave if your finance requirements can not few satisfied with a few hundred dollars. This application enables the users to borrow up to $1000 per pay period. For the same, you will be charged a fee of 8% of the total borrowed amount. However, the users need to have good credit history to borrow a large amount.

The borrowing capability of any user is determined by the income and spending pattern. At the same time, users also get flexible repayment options where they can repay the amount as soon as the salary is credited or on a specific day.

Core competencies

- Variable advance amounts

- Flexible repayment options

- No In-app purchases

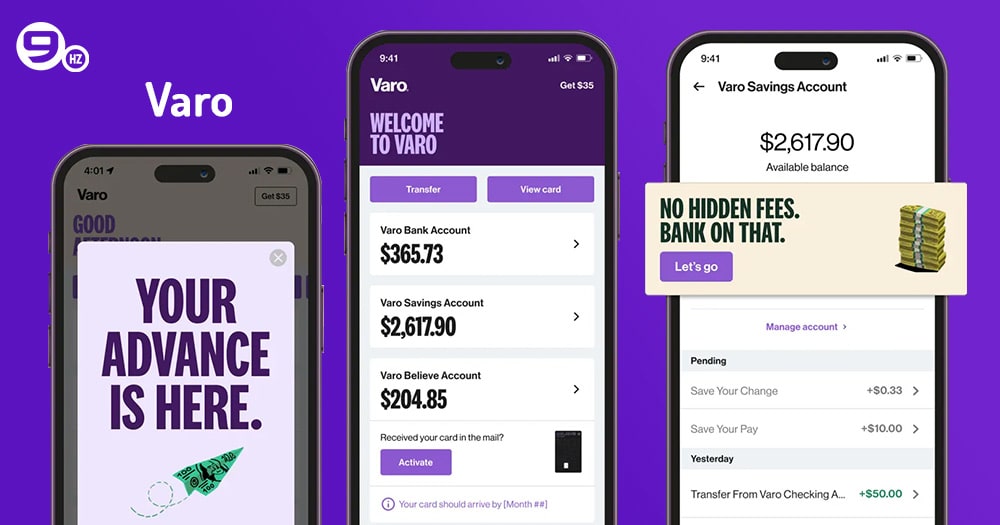

8. Varo

More popular as Varo Advance, this is one of the new cash advance apps. This application is accessible to those with atleast $1000 in qualifying direct deposits in their Varo Bank Account. The application allows the users to borrow any amount up to $250. As long as the amount doesn’t exceed $20, the services are not charged. Any amount above $20 is charged with a flat fee, ranging from $4-$15, depending on the exact borrowing amount.

The processing time for borrowing the amount is negligible. At the same time, users can even select the customized date within 15-30 days period from the date of borrowing. There is no membership fee for Varo Advance. Varo is a duly licensed bank in the United States which makes it a reliable platform for such transactions.

Core competencies

- Flexible repayment schedule

- Immediate processing time

- No charges to borrow amount less than $20

- Member of FDIC

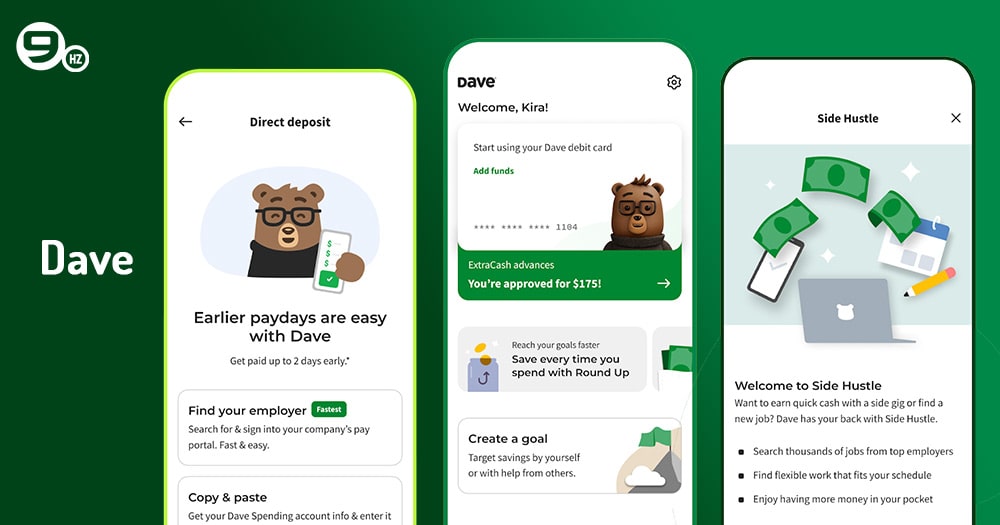

9. Dave – Best Instant Cash Advance App

Dave is a renowned platform to access an amount of up to $500 in advance in case of any emergency or to grab a good deal. The amount is transferred instantly to the account. Also, there is no late fees or interest charges on the borrowed amount. However, the users have to pay a monthly membership fee of $1 to leverage the services.

It takes approximately 2-3 banking days to reflect the amount in the user’s account. However, one can opt for instant transfer of funds by paying a minimal processing fee of $0.99-$3.99. The amount has to be repaid on the next payday strictly.

Core competencies

- Interest and charges free borrowing

- Additional money-making opportunities inside the app

- The last formalities to borrow money

- Consistent income and spending habit to borrow the amount

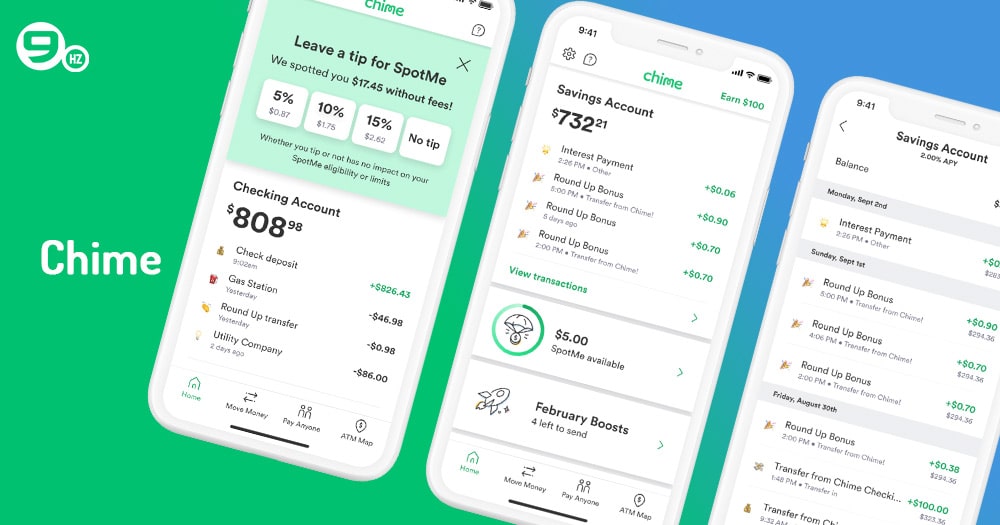

10. Chime

Also known as Chime SpotMe, it is a fee-free service offered by Chime that allows users an overdraft of up to $200 for a Chime checking account. However, you must have a direct deposit of $200 in your Chime Checking account every month. The new users have to start from a limited overdraft value of $20 which can be increased with regular deposits and solid account history.

If the user receives the paycheck via direct deposit into a Chime Checking Account, they can access their entire salary 2 days in advance. Same-day turnaround time makes it one of the best cash advance apps in the landscape.

Core competencies

- No tipping obligation or fees

- Low monthly direct deposit eligibility

- No minimum balance requirement

- No foreign transaction fees

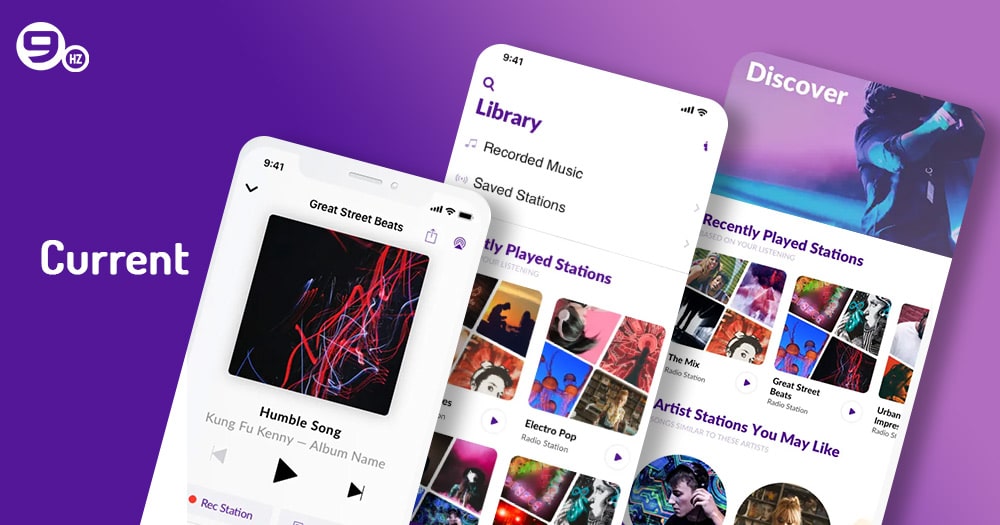

11. Current Overdrive

The name of the application is Current which offers the Overdrive feature of granting access cash of up to $200 to its users. The borrowing is done without any overdraft fee. However, there a certain criteria that make the user eligible for getting free money on the cash app. One must receive $500 or more in the qualifying deposits into the current account within the past 30 days of borrowing.

There are a range of advantages like competitive APY rates, credit builder cards, the opportunity to receive the salary up to 2 days in advance, and much for using the Current Overdrive application.

Core competencies

- A robust network of 40,000 fee-free ATMs

- Repayment flexibility of up to 60 days

- Immediate processing time

- No membership fee

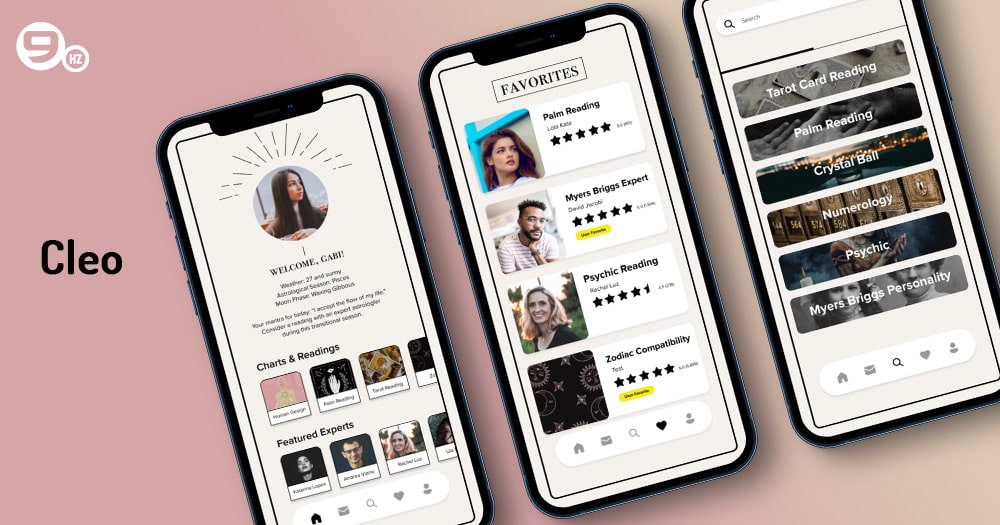

12. Cleo

Cleo is basically an AI-powered cash advance and budget app that aims to provide financial help to gig workers and freelancers. The biggest difference between Cleo and other names in the list of best cash advance apps is that you don’t have to show any regular deposit in your bank account to claim the advance money.

However, the only eligibility to get an advance paycheck of up to $250 is that you must have a consistent earning for every month from some source. Users have to opt for a monthly subscription plan of $5.99 to leverage the services from this app. Also, one can pay an additional fee of $3.99 to get the instant or same-day transfer.

Core competencies

- No payslips required

- Set monthly goals to track spending habits

- Get instant withdrawal

- Loan amount varying from $20-$250

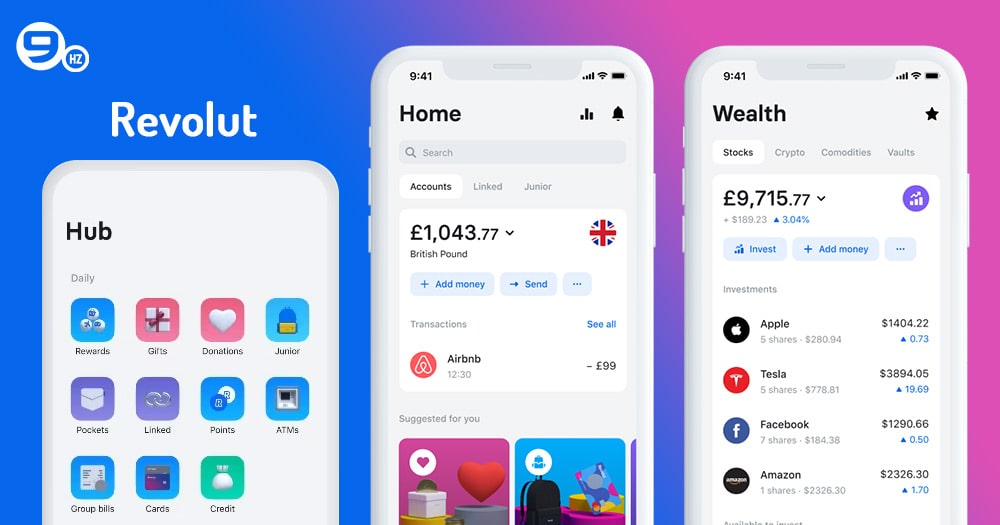

13. Revolut

In case you want to access your entire salary in advance, Revolut can be the best cash advance app for you. Not certain dollars or any limit, but you can request your complete salary amount from Revolut in advance. For the same, you must be registered for direct deposit of your salary in a Revolut account. One can receive the funds 2 days earlier by using this application.

Moreover, Revolut even allows the users to manage as well as block unwanted subscriptions, access the secure saving vaults with the best APY rates, earn rewards from the merchants, and enjoy the perks on travel as a paid member.

Core competencies

- Access to entire salary in advance

- No membership fee

- Additional features like attractive APY rates

- Multi-currency support

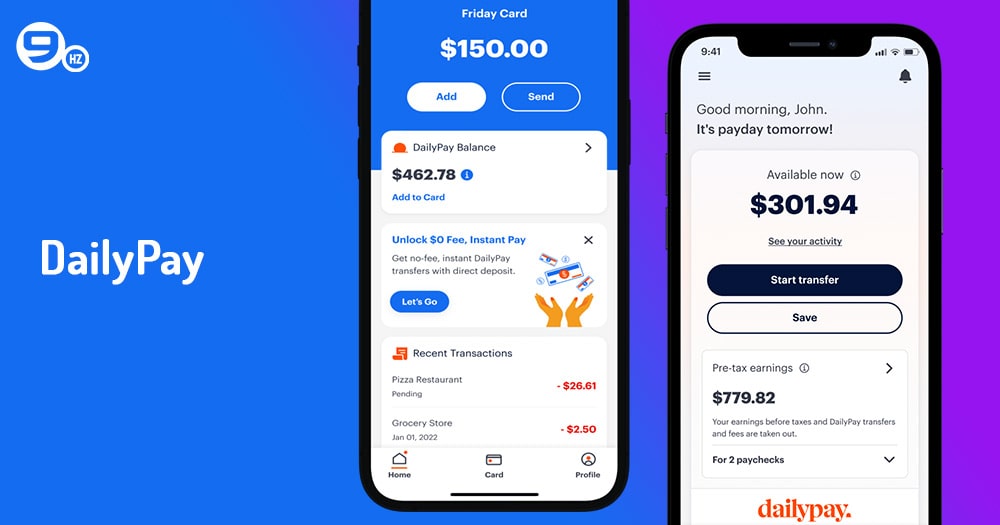

14. DailyPay

It would be better to define DailyPay among the new cash advance apps that deliver flexibility to employees and workers to access their paychecks before payday. Be it daily, weekly, or monthly earnings, you can utilize the check even before it has been credited to your account. So, it doesn’t count as a loan that you have to repay after a certain time.

However, the money you have utilized by accessing your paycheck earlier will be deducted when you receive the paycheck at the end of the day after the month or anytime according to your particular pay schedule.

Core competencies

- Transfer balance to a bank account, debit card, prepaid card or pay card

- Timely insights into daily pay balance

- 256-bit level encryption

- Withdraw or repay at any time

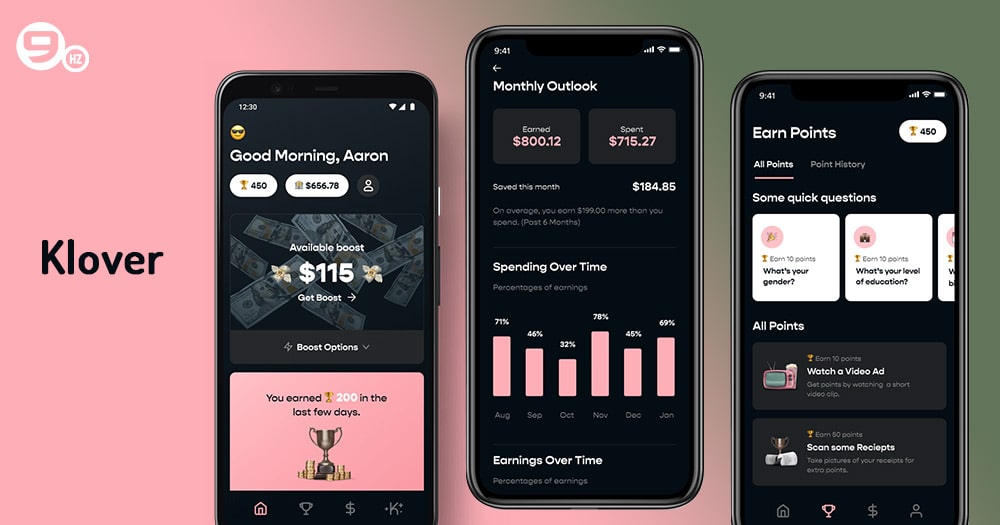

15. Klover

From $5-$200, Klover allows the users to borrow an amount on a flat fee of 3.5% of the borrowed amount. This is one of the best cash advance apps that give cash advances for small needs before the paycheck knocks on your door. However, the application is said to have some privacy issues and is not suggested to users who are very concerned about the safety of their data.

One can access the additional access to $100 by taking part in their point program. This program asks the users to share their receipts, answer quizzes, and watch short videos to earn points and leverage the cash services.

Core competencies

- Point program

- Repayment on next paycheck or within 7 days of borrowing date

- Instant fund transfer feature

- Optional tip

Alternatives to Cash Advance Apps Like Dave

If you don’t find it comfortable or reliable to use the above-defined best cash advance apps, there are multiple formal and informal sources of advance apps that you can turn to. Here are the top methods that will help you get financial assistance before you get your paycheck in your hands-

1. Ask Employer for an Advance- If you have good relations at your work and you find your employer supportive enough, this can be the best alternative to the cash advance app.

2. Take a loan from any CDFI- Community Development Financial Institutions are the local banks and credit unions that you can rely on to take small loans for short periods.

3. Short-term lenders- You can find many short-term lenders like LendUp which offer short-term loans at a comparatively lower cost as well as provide you a chance to build your credit score.

4. Personal loan- This is one of the direct approaches to meeting your financial needs when you have no money in hand. However, you might have to pay heavy interest when choosing this method.

5. Credit card cash advance- If high-interest rates don’t bother you, your credit card can easily arrange some cash for you. For the same, you can withdraw the cash from any legitimate ATM.

6. Buy Now Pay Later apps- These are the apps that will enable you to buy things but won’t transfer the cash in your account. You can pay off the price when receive the salary.

How Do Free Instant Cash Advance Apps Work?

Before becoming a user who relies on free instant cash advance apps to cover anonymous expenses, it is important to have a slight idea about how these software work, it will help you ensure that you are relying on the right app and recognize the unofficial permissions and access that such apps ask from you-

1. Registration

First of all the user has to download the application and register in the app by providing some necessary information. It includes name, address, occupation, employment details, and basic banking information.

2. Verification process

All the best cash advance apps have a verification process to ensure that the email and phone number of any user is not being used by any third party to borrow money. For the same, contact verification, employment identity, income proof, etc. are verified by the app.

3. Eligibility verification

Most of the apps that give cash advances place the eligibility criteria so that they only lend the money to users who are capable of paying them back. In this step, factors like income, employment history, and other criteria are used by the application.

4. Loan approval

Once all the verifications and formalities have been completed, the user can request the loan. The loan amount varies according to the particular apps along with the flexibility in the repayment time. Also, many apps have limitations on the amount users can borrow in one pay period.

5. Fees and repayment

Whale some call it fees, some subscriptions, and other interest, there are particular charges associated with cash advance apps. The application charges you a certain percentage of the borrowed amount. Similarly, other apps might charge you a monthly subscription or a mandatory tip on the borrowed amount for using the services.

At the same time, all the cash advance apps come with their respective protocols for the date of repaying the amount. Users have to clear the dues on that day.

6. Credit check

If your cash advance app is asking your permission for a credit check, you need not worry or hesitate. It is one of the standard practices that best cash advance apps use to evaluate if the user has a good loan repayment history.

7. Security measures

Such applications come with efficient security measures to protect the personal as well as financial information of the users. Techniques like encryption, secure transmission, and user authentications are utilized for the same.

Tips for Choosing the Right Cash Advance App?

Relying on one of the above apps can be an easy way to choose the best cash advance apps, however, you must have the basic understanding to evaluate if a particular software deserves space in your financial planning or not. Let’s go through some tips that will help you choose the right cash advance app-

1. Research and reviews

Carrying out good research and reading the reviews given by the existing users can be a great idea for you to lend to the right cash advance apps. The reviews and ratings bring important insights like usability, ease of use, the experience of real-time users, and much more, that help you make the right decision. Similarly, research will help you know about the better alternatives and market leaders in cash lending apps.

2. Transparency in Terms and Fees

You must read the terms and fee structure of any app you are planning to use. Several hidden charges and terms can influence your finances which are very important for you to know about. You should also evaluate their business model whether they charge a standard fee or a percentage of the borrowed amount.

3. Loan limits and eligibility criteria

There are different loan limits provided by different cash advance apps. You should choose the one that can fulfill your financial needs and provides a paycheck that matches the amount you prefer. More than that, you should also evaluate the eligibility criteria that you have to pass to take the loan.

4. Reputation and brand image

Every app, software, or entity has its brand image in the market for particular products and services. You can analyze how each app is performing in the money lending industry and what people have to say about it. While you should not believe the rumor, going completely against the views of the masses is also not a good idea.

5. Security measure

You should prioritize the apps that prioritize the users and their information. Look for the applications that keep your financial data and personal information encrypted, secure, and practice the safe transmission of your data as well as robust privacy policies.

6. Customer support

It is hugely important that the cash advance app that you choose the good customer support. The application should have an AI-based chatbot that provides 24*7 support and assistance to the costumes. Moreover, support via live chat, phone, and email is also an essential part of the best cash advance apps.

7. Repayment flexibility

Different apps provide different repayment flexibility. Choosing an app that asks you for repayment in less than 2 days can be nothing less than a headache. So, pick up the best instant cash advance apps that allow you to take ample time for repayment without any additional charges.

8. Mobile usability

The UI and UX of the app should be mobile-friendly where you can navigate and access all the features from your smartphone screen. A user-friendly interface will enhance the user experience and you can better manage your advances and finances.

Conclusion: Best Cash Advance Apps

So, cash advance apps are the great and burgeoning platforms that help you access the advance paycheck to cover your emergency expenses. However, it is important that you choose the right cash advance apps no direct deposit required for your money needs. We have listed the 15 best cash advance apps that will help you get financial help without any significant charges. Most of the best instant cash advance apps foster the subscription, tip, and interest model to cover their app development cost and make a profit from the business.

FAQ’S On Free Instant Cash Advance Apps

Q1. What is the Best Instant Cash Advance App?

BrigIt and Chime are some of the best cash advance apps that you can use in order to get financial support before your paycheck.

Q2. Where Do I Get Instant Money?

There are many best cash advance apps that help users borrow a particular amount before their payday without much formalities.

Q3. What App Will Let You Borrow Money Instantly?

Not one, but there are multiple apps that enables you to borrow money instantly. The best ones include Chime, Brigit, Dailypay, Cleo, and Current Overdrive.

Q4. How Can I Borrow Money and Get it Instantly Online?

Many cash advance apps allow users to make a request to borrow money and receive the amount instantly. Similarly, other apps provide this service against a particular fee.

Q5. What Cash Advance App Does Not Use Plaid?

Apps like PayActiv, Possible Finance, EarnIn, Chime, Empower, etc. don’t use plaid.

Great Together!